Log in

Build Your Site

Best Personal Finance Blog Examples for Budgeting and Wealth

How to balance your personal finances? Where can I find finance blog examples for budgeting and wealth? You can check this guide to get more inspiration!

In an era of soaring prices and economic uncertainty, managing your personal finances is a survival skill that everyone should have. Have you ever been anxious about your finances? Do you feel stressed by your credit card bills? Or do you want to make some plans for the future but don't know where to start? Don't worry, you are not alone. More and more people are looking for practical and down-to-earth financial advice, and personal finance blogs are an ideal place to start.

In this post, we have carefully selected the top personal finance blogs worth reading in 2025. These blogs provide accurate information, but also plain and close to life, and can help you go from "not understanding financial management" to "actively planning your life."

Let's read on those financial blog examples and take the first step to improve your financial situation.

Why should you follow the top personal finance blogs?

In the digital age of information explosion, following high-quality financial blog examples is a way to keep up with the times. It is also important to improve financial literacy and make wise decisions. The following points explain why following financial blogs is of great benefit to you:

-

Get professional insights

Experienced experts and financial advisors usually write financial blogs. They analyze daily financial topics such as budgeting, investing, credit scores, and debt management, helping you transform complex financial terms into easy-to-understand and actionable advice. Following these blogs is like getting guidance from a personal financial coach regularly.

-

Keep up with market trends

The financial world is changing rapidly. From stock market trends to interest rate policies and tax changes to optimizing retirement plans, they are all key factors that affect your wallet. By reading blogs regularly, you can understand these changes the first time and adjust your financial strategy accordingly to have a clear mind and not react passively.

-

Enhance risk awareness

Many personal finance blogs not only talk about "how to make money" but also remind you, "Don't lose money." Whether identifying credit card traps or being wary of investment scams, high-quality blogs can help you be more vigilant. And reduce the risk of making wrong decisions due to insufficient information.

-

Get useful tools and templates

Many financial blogs also provide free tools such as budget forms, savings plan templates, and retirement calculators. You can immediately use these resources to help you turn "I should manage my finances" into "I am managing my finances."

-

Build a long-term financial mindset

Following these blogs gives you instant advice and helps you build a long-term financial mindset. From short-term budgets to mid-term investment plans to long-term wealth accumulation, high-quality blogs can help you see the bigger economic picture.

-

Save time and money

Filtering out the content useful to you from a sea of financial information is time-consuming and laborious. Following a few trusted blogs is equivalent to having a group of "behind-the-scenes think tanks" willing to filter information. And organize knowledge for you, helping you make smarter decisions while saving costs.

If you are embarking on the road of personal finance or looking for direction for your financial goals. Then, following these excellent financial blogs will provide continuous support and inspire you to take each step more steadily and further.

Top personal finance blog examples

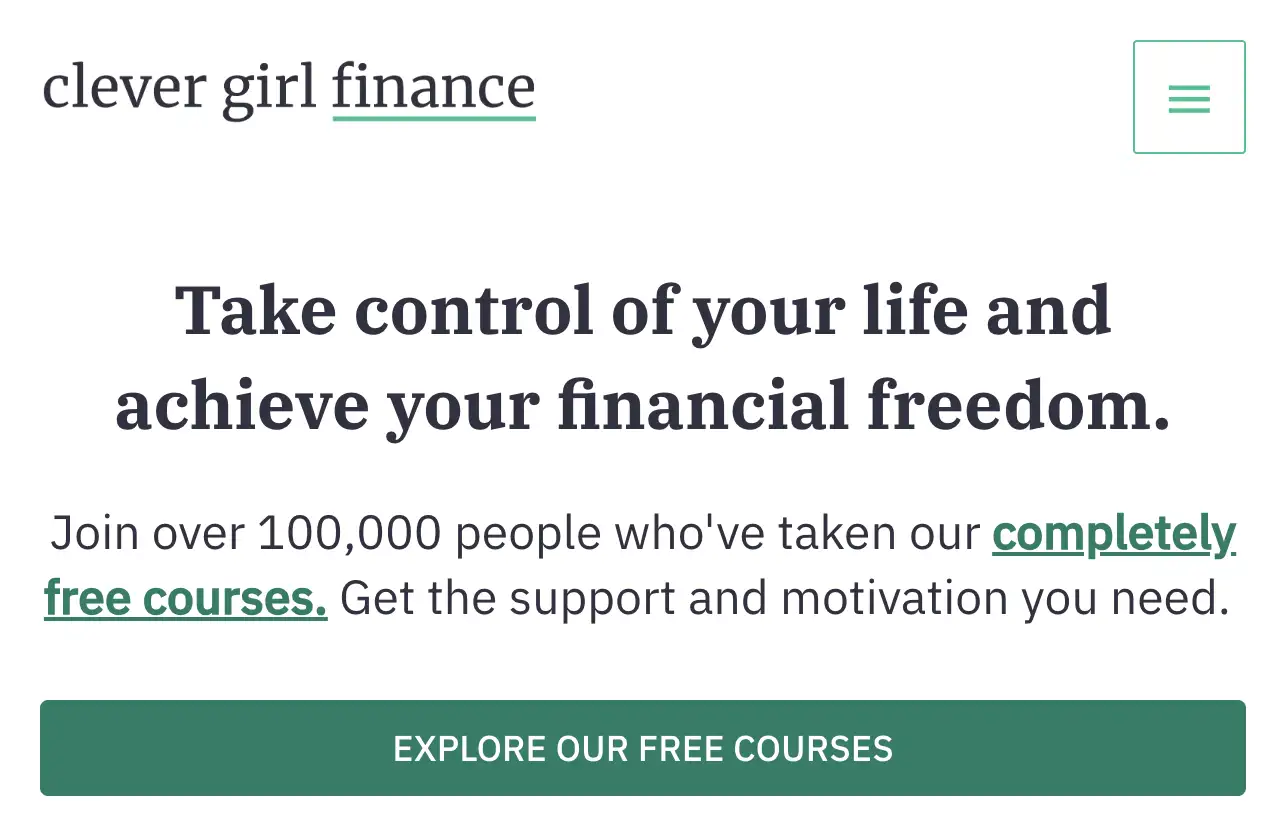

1. Clever Girl Finance

If you want to start managing your finances but don't want to be overwhelmed by the jargon and buzzwords, you should check out Clever Girl Finance. This money blog, tailored for women, was founded by Bola Sokunbi, a certified financial instructor and a real-life financial expert who saved $100,000 on a $54,000 annual salary.

The blog's content is down-to-earth, covering budgeting, debt repayment, saving, and investing. The key point is that it doesn't make you feel that "financial management is something high and mighty." Bola's tone is friendly and powerful. She doesn't care about how much money you have in your account now, but whether you have the courage and motivation to change the status quo.

The best part is that almost all the resources on this platform are free. 30+ financial management courses can be learned online anytime, various budgeting tables and gadgets are provided to help you sort out your thoughts, and many financial challenges can be completed at home to develop good habits while playing.

More importantly, Clever Girl Finance creates an atmosphere of "you are not fighting alone." There is a passionate female community behind the blog, where everyone grows together and encourages each other. It is very suitable for those still uneasy about financial management. Why is it still recommended in 2025? Because it provides not only knowledge but also a force for continuous progress. If you want to find a financial blog that is both reliable and can bring warm support, then it will not let you down.

Image by Clever Girl Finance

2. Money Crashers

When you first start making money, you wonder why you never have enough money to spend. Then you have to know the Money Crashers.

This is a financial education platform for all those who "take their wallets seriously." Whether you are a new graduate in the workplace or a young family trying to plan for the future, Money Crashers can provide what you need: from reducing debt and building emergency savings to investment, real estate, and even entrepreneurial advice and public policy analysis. The content is very comprehensive and practical.

If you are looking for a blog example that does not preach or sell courses but honestly tells you how to live and support yourself, then Money Crashers is a very worthy choice. It is not fancy but very down-to-earth, suitable for those who want to find direction from financial chaos.

Image by Money Crashers

3. Afford Anything

Afford Anything, one of the best financial blog examples, is not a blog that teaches you how to save money for coffee. It is a blog that teaches you how to use money to buy true freedom. This blog, founded by Paula Pant, a world traveller and real estate investor, revolves around a subversive idea: you can't afford everything, but you can afford everything most important to you.

Paula's method is not "how to save" but "how to choose." She encourages us to consciously cut those unimportant expenses and invest generously in the things that matter. Do you want to retire earlier, start a meaningful career, or achieve financial independence? Her blog can give you practical strategies, but more importantly, it will help you change your mindset.

Afford Anything is not a traditional money blog. Paula wants to help you build a "life with choices." Her writing is profound but not complex, practical but not dull, and often makes people reflect on the direction of their entire life while reading it.

So why should you still read it in 2025? Because we all deserve a life of "living for a purpose" instead of "working for survival." Afford Anything is like a mind map to freedom; it teaches you how to live out infinite possibilities with limited resources.

Image by Afford Anything

Want to create your personal finance blog? Try Wegic!

If you've always wanted to organize your financial thinking or hope to help more people build good financial habits by sharing your own experience, then Wegic is undoubtedly your ideal partner. As an AI-driven website design tool, Wegic can help you easily create a top personal finance blog without requiring you to have any programming or design skills.

Log in to Wegic and go directly to a conversational creation interface. The cute AI assistant Kimmy will first ask you some simple questions, such as the website's type, name, language, and style. When you tell it that you want to create a blog to record personal financial experiences and help others, it will immediately understand your needs and make several suggestions for website structure, such as:

-

Homepage: Display blog introduction, writing ideas, and latest articles.

-

Financial thinking: Categorize your financial management methods, investment experience, and budget planning skills.

-

Tutorial resources: Share your favorite financial books, tools, and video courses.

-

Blog articles: Regularly update financial management-related content, from saving money tips to asset allocation.

-

Contact information: Allow readers to ask you questions, communicate, and even cooperate.

After confirming these, Wegicwill quickly generate the first draft of a website with a beautiful appearance and reasonable content. You can modify any content with the mouse, or you can modify it directly through the chat box on the right side of the editing interface. For example, "Please change the main color of the website to green, which symbolizes wealth and growth," and "Change the homepage to a warmer and more intimate picture." Wegic can understand and provide a variety of modification plans for you to choose from.

This "building a website like chatting" method makes building a financial blog no longer a headache. You can classify and organize the experience you have summarized in accounting, savings, and investment, and you can also share these valuable experiences through blog articles so that more people who are confused on the financial road can be inspired and helped.

When you are satisfied with the website's content, you can launch your blog with one click and get a free exclusive link. If you want more personalization, you can also bind your domain name. In the future, whether you update content on a computer, tablet, or mobile phone, Wegic can guarantee the responsiveness and experience of the website display.

Wegic not only makes "blogging" simple but also makes "organizing ideas and outputting value" an easy and meaningful thing. For everyone who wants to record their growth with words and illuminate others with their experience, Wegic is not just a tool but more like an intelligent partner to help you build your dreams. You can create the best money blog with Wegic!

Click the picture here to find out Wegic's best practices! ⬇️

https://wegic.ai/best-practices

Conclusion

Whether you are a novice in financial management or on the road to accumulating wealth, these excellent money blog examples provide practical, honest, and down-to-earth inspiration. From simple and easy-to-use accounting skills to in-depth investment ideas, from personal experience of paying off debts to practical routes to achieve financial freedom, each blogger tells us in their way: financial management is not a cold digital game but a kind of control and choice over life.

Their success is not because of high income or a perfect start, but because they are willing to continue learning, face problems, and share their experience with more people without reservation. These blogs are a treasure trove of knowledge and a kind of companionship. Maybe you will find a method that suits you, or you may be inspired to record your financial experience. Now, start following a blog that resonates with you and take the first step towards financial freedom!

Written by

Kimmy

Published on

May 6, 2025

Share article

Read more

Our latest blog

Webpages in a minute, powered by Wegic!

With Wegic, transform your needs into stunning, functional websites with advanced AI

Free trial with Wegic, build your site in a click!