登入

打造你的網站

7 Expert Tips on How to Price a Business for Sale

Discover 7 expert tips on how to price a business for sale effectively. Maximize value, attract buyers, and close deals with confidence using these proven strategies.

When you want to sell your company, setting the price is often the hardest part. It is one of the most important decisions you will make in the whole process. If the price is too high, buyers may lose interest and walk away. If the price is too low, you risk losing the money you deserve and undervaluing your hard work. That is why learning how to price a business for sale is so important for every seller.

Many people start by setting a price based only on feelings or personal expectations. But the market does not work like that. Buyers will always look at solid facts, like industry data, your company’s financial health, and the potential for future growth. If your price does not have a clear reason or supporting numbers, buyers will question it. In many cases, they may lose confidence, and some will not even start a conversation with you.

The good news is that pricing your business does not have to be overwhelming. With the right knowledge and a few key skills, you can set a price that attracts serious buyers and still keeps the full value of your company. For example, if your company relies on high-quality e-commerce hosting services, showcasing this can strengthen your valuation and make the offer more appealing to potential buyers.

In the next sections, you will find very clear and easy-to-follow methods. These ideas come from real experience and have helped many sellers succeed. They are simple to understand, practical to apply, and can be used for almost any business. If you are planning to sell your company, these tips can save you a lot of time, reduce stress, and make the whole process much smoother.

Click on the image to get more tips 👇

Expert Tips on How to Price a Business for Sale

Understand Your Business’s True Value

Before you decide to sell your company, the first step is to really know what it is worth. Many people want to know how to price a business to sell, and the key answer is to know your value first. If you do not know how much your company is worth, it is hard to get a good price from buyers.

To know your company’s value is not only to look at cash or equipment. Buyers care about the whole picture, like profit, assets, future growth, and market position. Three common ways can help you start:

Asset method: look at all things your company owns, both things you can touch and things you cannot, like equipment, stock, and intellectual property.

Income method: set the price based on future profit, better for companies with steady cash flow.

Market method: check how similar companies were sold and learn from those prices.

Which way to use depends on your company, and sometimes you use more than one together. When you know the true value, you can talk to buyers with confidence and avoid losing chances because of wrong pricing.

Get a Professional Business Valuation

If you want to sell your company, finding a professional business valuer is very important. Many people want to know how to price a business to buy, but a fair price often needs real data and analysis, not guessing.

When you do it yourself, the result is often not right. Sellers may think too highly because they have affections for the company. Buyers may think too low because they want a cheap price. A professional valuer is fairer. They look at financial statements, cash flow, market trends, and industry data to make the price more convincing.

A professional valuation also saves time. You do not need to study a lot of hard data yourself. You also do not need to argue with buyers about how much it is worth. A professional report gives you confidence and makes buyers trust your price more.

A professional valuation makes the price fair, the talk easier, and helps you get better returns in the market.

Analyze Market Trends and Industry Benchmarks

When you set a price for your company, knowing market trends and industry benchmarks is very important. Many people want to know how to value a business, and one answer is to look at market data, not only at your own company.

Market trends can change what buyers will pay. If your industry is growing fast, buyers may pay more. If the industry is going down, you may need a more competitive price. By checking the newest data, you can find a better price range.

Industry benchmarks are also important. Look at how similar companies are priced and sold. Things like profit margins, revenue multiples, and market value of others can help you see if your company is priced too high or too low. Investing in your business image also plays a role; for example, a well-designed small business website can position your company more competitively and influence how buyers perceive its value.

Doing this gives your price stronger support and makes buyers trust you more. Remember that markets always change. Stay flexible with pricing and use the latest trends. This way, you can have an advantage in talks and attract the right buyers more easily.

Consider Financial Performance and Growth Potential

When you are trying to decide your company’s price, financial performance, and future growth are what buyers care about most. Many people search for how to price a business for sale calculator because they want an easy way to estimate the value. But in real practice, you need to look at some key points.

First is profit. Buyers usually check net profit and gross margin. If your company keeps making steady profit, the price can be higher. Next is cash flow. Stable cash flow shows the company runs well and gives buyers more trust.

Besides current results, growth potential matters too. If your company is in a growing market, has new product plans, or a rising number of customers, its value will go up a lot.

When you prepare data, list income, profit, cash flow, and growth plans clearly. These details help buyers see the value and make your price stronger. In short, the clearer the numbers, the easier buyers will accept your offer.

Factor in Intangible Assets

When you set a price for your company, many people only look at income and profit, but intangible assets are also very important. If you want to know how to value a business for sale, you cannot ignore brand value, customer loyalty, and intellectual property.

Brand value makes your company more attractive in the market. If buyers believe the brand already has a good reputation, they will be willing to pay more. Customer loyalty is also key. Loyal customers mean steady income and lower marketing costs, which shows long-term value to buyers.

To include these in your price, you should show clear data, like brand influence reports, customer retention rates, and a list of intellectual property. This not only gives strong support but also helps buyers see the hidden value, so they are more likely to accept your price.

Prepare for Negotiation Flexibility

When you set a price for your company, negotiation is something you cannot avoid. To learn how to value a business quickly, you need to know your company’s value and also how to stay flexible in talks.

First, set two prices: your lowest price and your target price. The lowest price is what you can accept at a minimum. The target price is what you hope to get. This way, you will not be led by buyers and will know your limit clearly.

Also, leave some room for buyers. If your price is too fixed, many potential buyers may walk away. Some space in talks makes them feel they can “win” the deal, so they will keep talking with you.

In addition, prepare data and reasons to support your price, like company results, cash flow, and customer data. For example, if your business relies on a well-built e-commerce website, highlighting this strength can increase buyer interest and provide stronger justification for your target price. Stay flexible but do not give in too fast, and you can reach a better deal within a fair range.

Work with Experienced Advisors

When you plan to sell your company, working with professional advisors makes the process easier. Many sellers who learn how to price a business for sale find that business brokers, lawyers, and financial advisors can help a lot.

Business brokers know the market. They understand how to find the right buyers and how to show your company’s value. Lawyers can help with contracts, terms, and legal risks, so you avoid problems in the deal. Financial advisors can study data, prepare reports, and make sure your price is fair and well supported.

When choosing a team, it is best to pick people with experience. They should know your industry, market trends, and what buyers think. You can talk to several first, compare their plans and fees, and choose the one that suits you best.

With a strong team, you can set a more accurate price and feel more confident in talks. They save you time, reduce risks, make the sale smoother, and help you get a better deal.

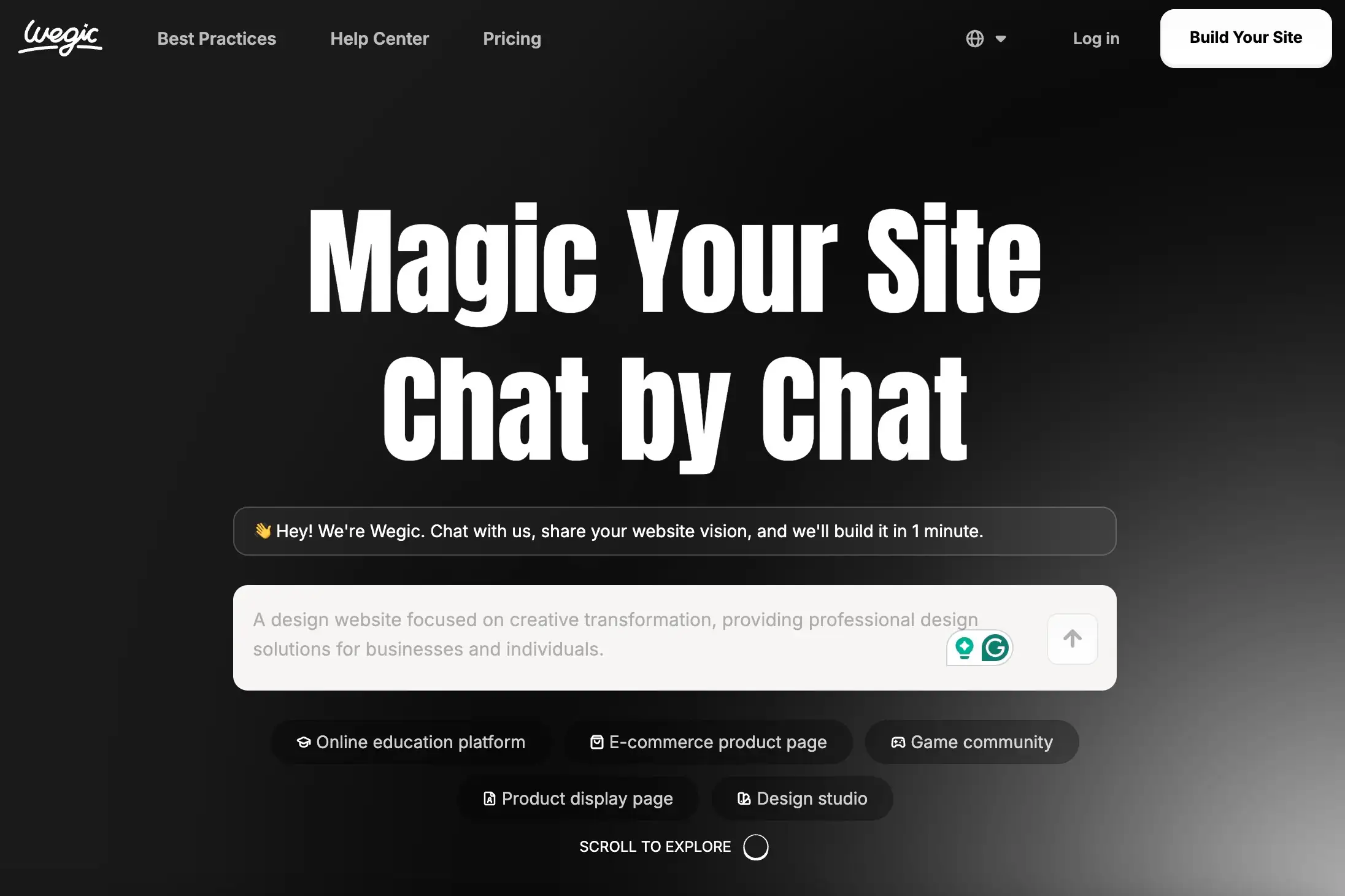

Make the Process Easier with Wegic

When you set a price for your company and look for buyers, many people feel there is too much information and too many steps. You indeed need to study finances, know the market, and prepare negotiation materials. These alone can feel overwhelming. If there is a way to make this work clearer and faster, you can save a lot of time and effort.

Now, some AI-based tools can help, such as Wegic. Its idea is simple: use conversation to let you manage and show company information easily. For example, when you are ready to sell your company, you need a clear and professional website to show buyers your business strengths and financial situation. Wegic makes this easier because it can quickly create pages and keep content simple, so buyers can understand your company faster.

It cannot replace professional valuation or a legal team, but it can make the whole process more efficient. For many sellers, having a simple and clear company page often leaves a good impression on buyers and helps talks go more smoothly.

If you are learning how to price your company and prepare to sell, using such tools lets you focus on key steps like negotiation plans and growth strategies, instead of spending too much time organizing materials again and again. This way, you can move faster to what truly matters and make the deal progress better. Here is a comprehensive beginner's guide and Wegic web examples for your reference.

Conclusion

Selling a company is an important decision, and pricing is the most critical step in the entire process. Learning how to price a business for sale is not as difficult as it may seem if you follow the right approach. In this article, we shared 7 useful tips: know the true value of your company, get a professional valuation, study market trends, focus on financial performance, include intangible assets, stay flexible during negotiation, and work closely with experienced advisors.

A good and fair price can help you attract more serious buyers, shorten the deal time, and secure better returns. On the other hand, if your price is set too high or too low, you may lose valuable opportunities or even be forced to lower the price later to close the deal.

If you ever feel uncertain about pricing, do not hesitate to seek professional help. Business brokers, lawyers, and financial advisors can provide objective insights, guide you through the process, and make you feel more confident when talking to buyers.

In the end, always remember this: pricing is not just about picking a number; it is about presenting the real value of your company. With the right plan and clear strategies, you can reach the right buyers faster, make stronger deals, and close the sale at the best possible price.

撰寫者

Kimmy

發布於

Aug 31, 2025

分享文章

閱讀更多

我們的最新博客

Wegic 助你瞬間打造網頁!

透過 Wegic,利用先進的 AI 將你的需求轉化為驚艷且實用的網站

使用Wegic免費試用,一鍵建立你的網站!