登入

打造你的網站

10 Ways to Get Startup Funding in 2025 (Grants, Loans, Crowdfunding)

Discover 10 proven ways to get startup funding in 2025, including grants, loans, and crowdfunding. Learn how to get money to start a business and launch your dream successfully.

In 2025, there are more chances than ever to start a business, but the competition is also stronger than before. The startup world is growing fast, and many people have creative and exciting ideas. However, those who succeed are usually the ones who manage to secure enough funding at the right time. Without proper financial support, even the best ideas can be difficult to turn into real products, and keeping a strong team together becomes even harder. That is why finding the right way to get funds is more important than ever for new entrepreneurs.

The good news is that there are now more options for getting money than in the past, and they are more diverse and flexible. Whether you want to apply for government grants, connect with angel investors, pitch to venture capital firms, try crowdfunding, or get a small business loan, there is a solution that can work for your situation. In fact, some startups even leverage trusted free online auction sites to sell equity or products and raise capital quickly. Each option comes with its own risks, requirements, and potential rewards, so the key is to understand your needs and choose the funding method that fits your goals best.

If you are thinking about how to get money to start a business, do not worry, this article is here to guide you. We will share 10 effective and practical ways to raise funds for a startup in 2025. From traditional bank loans and investor pitches to innovative crowdfunding platforms and strategic partnerships, we will explain step by step where to begin, how to prepare, and how to improve your chances of success.

Ready to take action? Let us explore the best ways to secure funding in 2025 and help you take the first step toward building and growing your business with confidence.

Click on the image to get more tips 👇

Government Grants for Startups

Government grants are a very popular way for entrepreneurs to get money. The biggest advantage is that you do not need to pay it back. Once you get approved, you can use the money to start or grow your business. For people who are just starting and have little money, this is a very attractive choice.

In 2025, many countries and regions will have new grant programs for startups. For example, the Small Business Innovation Research (SBIR) program in the United States is still popular, and Europe has grants for green technology and sustainable projects. These programs are made to support startups with potential so they can grow faster in the market.

But grants are not “free money.” The competition is strong. To improve your chances, you need a clear business plan that shows your project’s value and market potential. You also have to read the requirements carefully and make sure all documents are correct.

If you want to know how to get money to start a business with no money, government grants are a great choice. They give you funds without debt and reduce pressure when starting a business. The next step is to find the right program and apply as soon as possible.

Small Business Loans

Small business loans are a common way for entrepreneurs to get money. There are two main types: traditional bank loans and online lending platforms. Bank loans usually have lower interest rates but have strict requirements, especially for credit scores. Online platforms are more flexible, faster to approve, and easier on credit score demands.

In 2025, the loan market is more competitive, rates are stable, and some platforms offer different repayment plans so business owners can adjust based on income. To improve your chances, prepare a detailed business plan and show steady cash flow and the ability to repay. For example, clearly estimating the cost of building a website or other major expenses can make your loan application stronger and help lenders understand your funding needs.

If you want to know how to get money to start a business with bad credit, online loans may be a good choice because they are less strict than banks.

Crowdfunding Platforms

Crowdfunding platforms are still very popular in 2025, like Kickstarter, Indiegogo, and GoFundMe. The advantage is that you can show your idea directly to supporters and let them invest, instead of relying on banks or investors.

To succeed, make an appealing crowdfunding page. Use simple language to explain your product, the problem it solves, and why it deserves support. Good pictures and short videos can help a lot.

But there are challenges. If the funding goal is too high, you might fail. If your project is late, your reputation could suffer. Picking the right platform, setting a realistic goal, and engaging with supporters are key to success.

Angel Investors

Angel investors are people who use their own money to invest in startups. They often invest in the early stage because they believe your idea has potential. Compared to institutional investors, they are more flexible and willing to take risks.

To get angel investment, you need a convincing startup story. Explain clearly what problem your product solves, how big the market is, and what growth potential it has. Keep your pitch simple and direct, and show the strength of your team.

In 2025, angel investors are especially interested in online businesses, AI, and sustainability. If you want to know how to get money to start a business online, finding the right angel investor is a good option.

Venture Capital (VC) Funding

Venture capital is for companies that want to grow fast. If your product is already proven in the market and you need a lot of money to expand users and market share, VC funding might be the best choice.

In 2025, top VC firms still focus on technology, health, AI, and green energy, such as Sequoia, Andreessen Horowitz, and Accel. To impress them, you need a clear pitch deck with strong data.

A good pitch deck should show market size, business model, user growth, profit plan, and team strengths. Keep it short and highlight the key value to stand out among many competitors.

Startup Incubators & Accelerators

Startup incubators and accelerators are still important resources for entrepreneurs in 2025. They not only provide funding but also mentors, resources, and connections to help you grow faster. Incubators are better for very early projects, while accelerators usually focus on companies that already have a product prototype and want to enter the market quickly.

Some key programs in 2025 include Y Combinator, Techstars, and 500 Global. Many successful companies, like Airbnb and Dropbox, started from these programs.

If you want to know how to get funding to start a business, joining an incubator or accelerator is a great choice. To increase your chance of being selected, prepare a clear business plan, show growth potential, and stay confident and genuine in interviews. Leveraging innovative tools like AI platforms for small businesses can also help you stand out from competitors and demonstrate scalability to investors.

Business Competitions & Pitch Contests

Business competitions and pitch contests are becoming more popular in 2025. They give entrepreneurs a chance to present ideas, win cash prizes, get investment, and gain media exposure. For new companies, this is a low-cost way to get funding.

Famous global contests include Startup World Cup, Hult Prize, and Web Summit Pitch. Many countries also have local contests to support small startups.

To stand out, you need a strong story and a simple pitch. Show what problem you solve, how big the market is, and what strengths your team has. Practice your presentation and stay confident to improve your chances of success.

Bootstrapping & Self-Funding

Bootstrapping is the first step for many entrepreneurs. It means using personal savings, credit cards, or early business income to support growth. The benefit is that you keep full control of your company and do not need to share ownership with investors.

However, bootstrapping has risks. If business grows slowly, cash flow can be tight. Planning personal finances well is very important. Set a clear budget, invest only what you can afford, and avoid hurting your personal life.

If you are thinking about how to raise money to start a business, self-funding is one of the most direct ways. Starting small and expanding as income grows is a smart way to lower risk.

Peer-to-Peer Lending Platforms

Peer-to-peer lending platforms are becoming more popular in 2025. Unlike traditional bank loans, the funds come from individual investors instead of financial institutions. This makes borrowing faster and requirements more flexible.

Popular platforms include LendingClub, Prosper, and Funding Circle. They usually offer different loan amounts and approve faster than banks.

To get the best rates, keep good financial records, show steady income, and compare platform terms. P2P lending is great for early entrepreneurs, especially those who cannot get bank loans. It helps you access startup funds quickly and grow your business.

Strategic Partnerships & Corporate Funding

Strategic partnerships and corporate funding are becoming more important in 2025. By working with big companies, small startups can get money, resources, and market access. This not only solves funding problems but also helps you enter the market faster.

Many success stories show this. For example, some tech startups partnered with large cloud companies to get funding and technical support. Retail brands grew quickly by working with major e-commerce platforms.

To get good partnership terms, negotiation is key. First, be clear about what value your company brings to the partner, such as innovative products or new market opportunities. Second, prepare a clear business plan and growth data to convince them with facts.

If you are thinking about how to get money to open a business, finding a strategic partner is a great option. It can give you funding, industry resources, and long-term support.

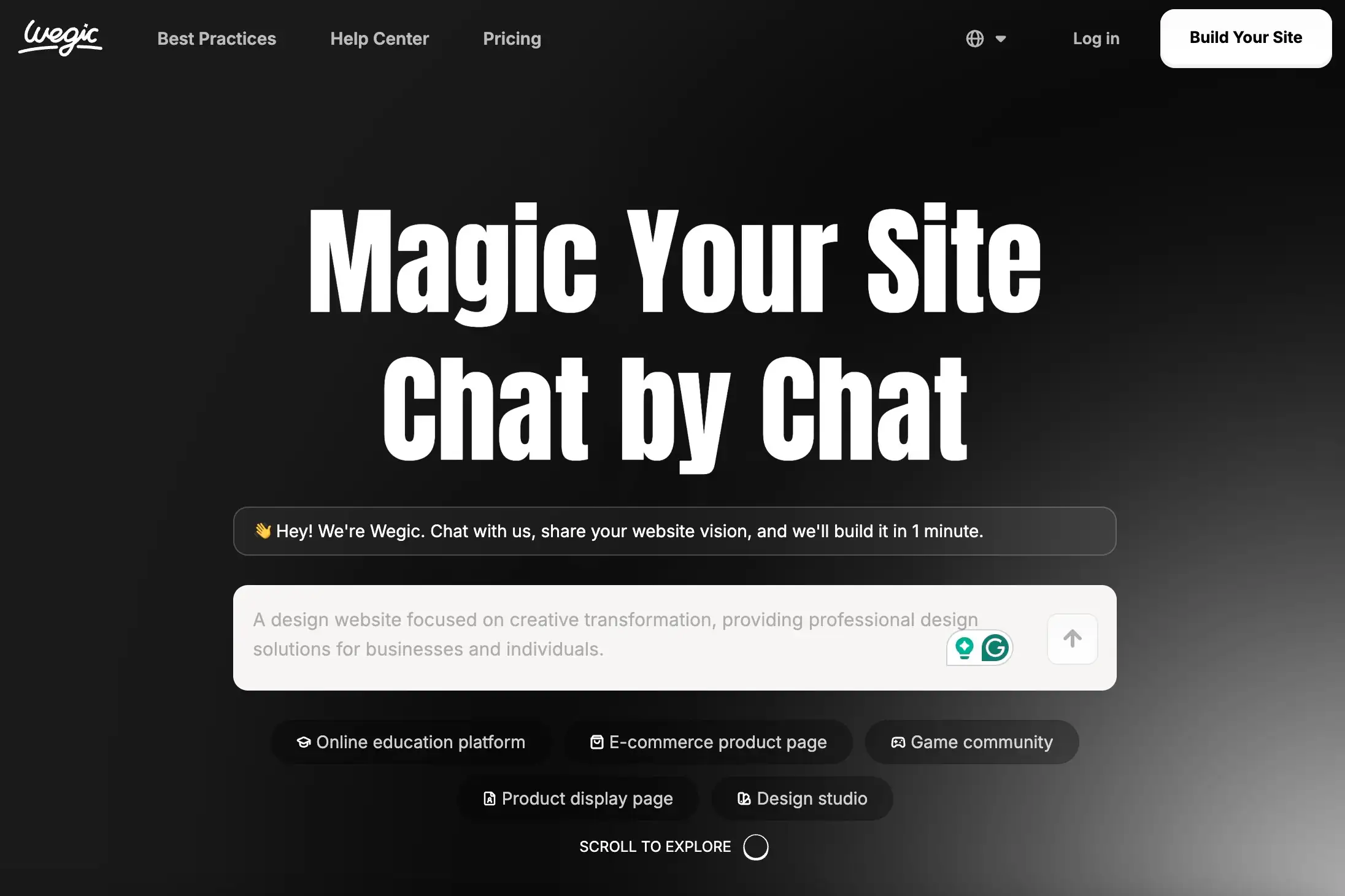

Use Wegic to Boost Your Funding Journey

When you look for startup funding, choosing the right financing method is important, but using tools well also matters. In 2025, the startup world changes fast, competition is strong, and information updates quickly. Many entrepreneurs face the same problems: not knowing where to start, lacking a clear plan, or not having enough resources to show their ideas. At this time, some new online tools can help a lot.

AI-powered platforms like Wegic can help you create business plans faster, design presentation materials, and make your project look more professional when you prepare for funding.

It is made for entrepreneurs and small businesses, helping you build a brand website quickly, improve how your content is shown, and make your project look more professional. For those who want to attract investors or run crowdfunding, this can bring more attention to your project.

In the end, getting funds still depends on your product and business model, but these tools let you show your idea better and save time. Compared to traditional ways, you can improve your project’s image at a lower cost, which is very helpful for early-stage entrepreneurs. Using these resources can help you move faster in the competitive startup market of 2025. Here is a comprehensive beginner's guide and Wegic web examples for your reference.

Conclusion

In 2025, entrepreneurs have more ways to get startup funds than ever before, and the opportunities are growing every day. Whether it is government grants, small business loans, crowdfunding platforms, or angel investors and venture capital, each option has its own benefits, challenges, and requirements. If you want to start with less risk, government grants or crowdfunding may be great choices. But if your goal is to grow faster and scale your business quickly, VC funding and strategic partnerships might work even better.

Also, it is important not to rely on only one method. The most effective plan is to combine different funding strategies to create a stronger foundation. For example, you can begin with crowdfunding to get your first users and early support, then use a business loan to keep your cash flow stable, and finally reach out to angel investors to help accelerate growth. This approach spreads the risk, builds credibility, and greatly improves your chances of long-term success.

If you are thinking about how to get money to start a business, now is the perfect time to take action. Prepare a solid business plan, research all available funding options, and choose the path that best matches your goals and resources.

Start exploring these funding methods today and turn your business idea into reality. Your dream of starting a successful business can absolutely come true — all it takes is taking the first step with confidence.

撰寫者

Kimmy

發布於

Aug 31, 2025

分享文章

閱讀更多

我們的最新博客

Wegic 助你瞬間打造網頁!

透過 Wegic,利用先進的 AI 將你的需求轉化為驚艷且實用的網站

使用Wegic免費試用,一鍵建立你的網站!