Log in

Build Your Site

How to Save Money: 10 Pitfalls to Avoid for Better Savings

Discover how to save money by avoiding 10 common pitfalls that sabotage your savings goals. Learn smart strategies to boost your financial future today.

Anyone has likely felt unable to save money at some point. I’ve been there too—staring at my paycheck, wondering how to save money when rent eats half my income, or guiltily swiping my card for another ‘quick’ online purchase. Your every dollar is already spent before you finish the month, and now you ask yourself: How do I save money from my salary? Or perhaps you’re juggling a tight budget, desperate for clever ways to save money fast on a low income without sacrificing every small joy.

The basic principle behind money saving stands contrary to the belief that it requires anything less than a comfortable living. You need to watch out for stealthy risks while applying methods that match your lifestyle. The content contains important information to assist anyone who wants to grow their savings and handle financial debt, or to create a money-growing plan starting from $5 savings.

I’ll show you how to save money smarter—not harder—by dodging the 10 most common mistakes (spoiler: you’re probably making at least 3 of them). You’ll learn how to save money from your salary like a pro, even if you earn ‘just enough,’ and uncover clever ways to save money fast that don’t require drastic cuts.

8 Clever Ways to Save Money

No mystical saving method exists because following purposeful strategies leads to financial security. Two effective methods will help you retain more money regardless of what you earn. This article will examine practical financial optimisation tools and show how to stop repeating mistakes while making small changes that produce significant financial savings.

Optimise Spending with Free Tracking Tools

To start your journey of financial knowledge, go through your money distribution process. The monthly spending on a daily $4 coffee equals utility bill expenses of $120. Most individuals who conduct two-week spending monitoring discover one or more costly items they can eliminate (such as unused subscriptions).

You should eliminate non-essential expenses to shift the money into savings.

Master the 50/30/20 Framework

Use three distinct sections to split your salary:

-

50% for Essentials: The budget distribution should allocate half of your income toward paying for essentials such as rent, utilities, and groceries.

-

30% for Lifestyle Choices: The Lifestyle Choices category takes up 30% of the budget, which includes costs related to dining out, hobbies, and streaming services.

-

20% for Savings/Debt: Emergency fund, retirement, credit card payments.

Reallocating funds from the lifestyle category will normalise the level of expenses in essentials when you exceed the 50% threshold. Homemade meals instead of restaurant takeouts create available money for your budget. Savings occupy a position of priority status because this system places savings at the forefront.

Trim Recurring Costs Creatively

When everyone regularly cuts a minor budget, they can achieve substantial financial success.

-

Negotiate Bills: You should get service providers to review and reduce your internet internet telephone, and insurance bills by directly calling them. When you mention competitor offers to service providers, they will usually match those offers.

-

Swap Brands: Opt for generic groceries or pharmacy items. Scientific studies demonstrate that generic products offer similar quality standards to luxury products.

-

Use Community Resources: Users can access free resources at libraries through books and movies, and tools, while parks offer cost-efficient recreational activities.

Small adjustments at first will accumulate into major benefits throughout the year.

Automate Savings to Outsmart Overspending

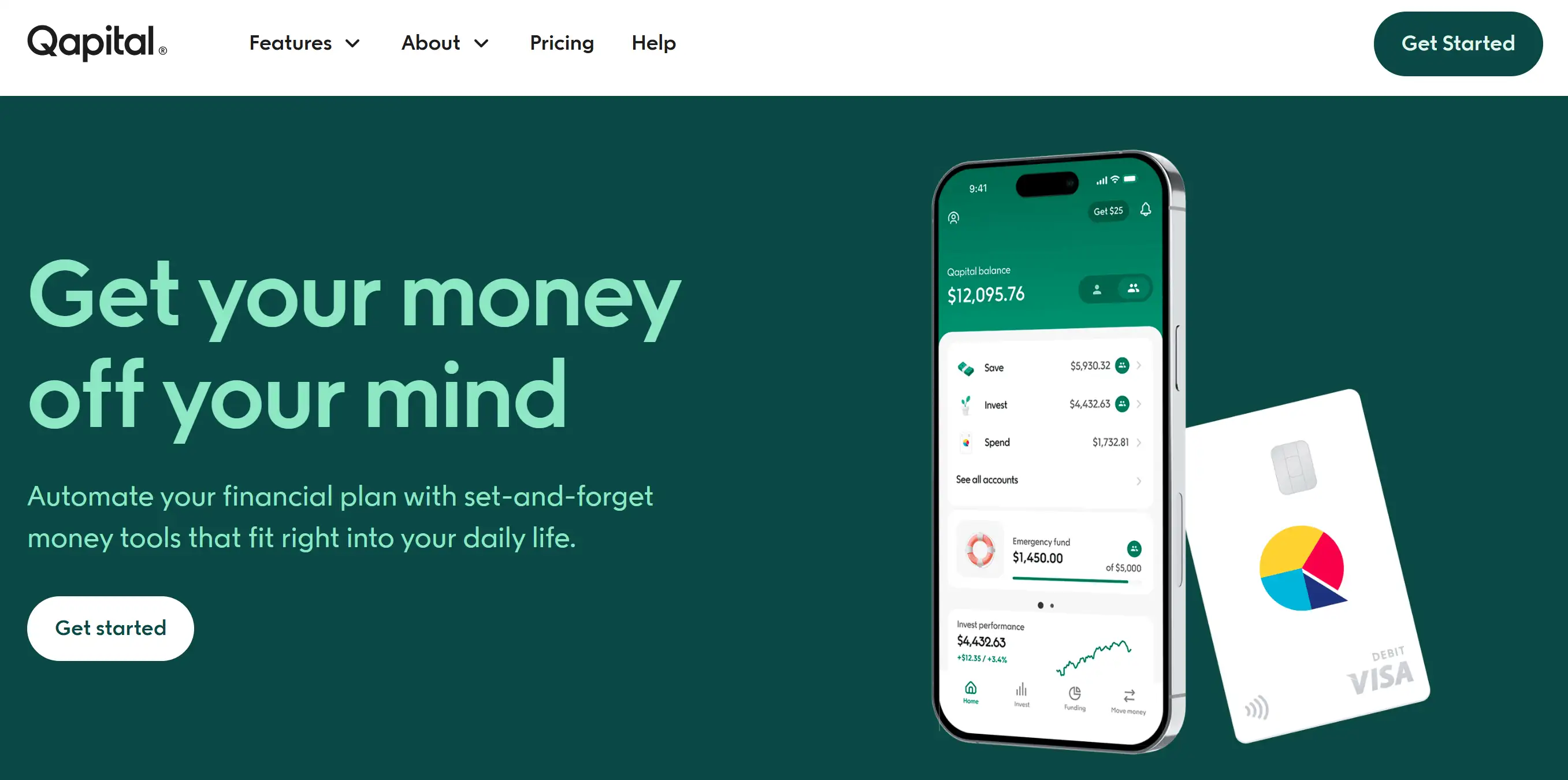

Your savings account receives automatic transfers the day after you get paid. A small amount of $25 each week will build up into $1,300 throughout the entire year for managing unexpected costs. Two popular savings applications, Qapital and Digit, track your financial activities before making automatic savings from surplus money. Implementing automation technology eliminates such temptations to ensure that savings methods operate as designed.

Boost Income with Flexible Side Hustles

Raising your income serves as an additional strategy after budget cuts fail to deliver adequate results.

-

Utilise Facebook Marketplace alongside Poshmark to sell disregarded possessions.

-

Profile your skills for Upwork and provide freelancing services such as copywriting or creative website design, or teaching.

-

Wegic presents a useful platform which enables users to develop websites for blogs and small business portfolios, and online profiles. Anyone can use the tool without programming expertise because it features simple drag-and-drop functionality.

Excess earnings help you save money at a faster pace, even while keeping your daily life untouched.

Avoid Debt Traps with Strategic Payments

Debt with high interest rates, specifically credit cards, destroys the ability to save money. Unwind your savings efforts by investing surplus funds toward debts that carry interest rates exceeding 7%. Start by paying the minimum amount required on all debts, then use extra money to immediately reduce the highest-interest debt balance first. After completing this one, continue the process by relocating to the payment of the following financial obligation. This reduces long-term interest costs.

Plan Meals to Slash Food Waste

The average household wastes $1,500 per year on uneaten food. Combat this by:

-

Creating a Weekly Menu: Buy only what you need.

-

Add last night’s leftover roasted veggies to an omelette so it doesn’t go to waste.

-

Shopping Sales: Use apps like Flipp to find discounts on staples.

Supermarket expenses can often be reduced by 20% by using several simple arrangements.

Rethink Transportation Costs

If car payments, gas, and maintenance strain your budget, consider alternatives:

-

Carpool with colleagues and split the fare equally.

-

Public transportation: Generally speaking, buying a monthly pass is more cost-effective than driving yourself.

-

Riding a bike or walking on short trips saves gas and keeps you healthier.

Consistency matters more than perfection. Start with one or two strategies, like automating savings or negotiating a bill, and then slowly try other approaches. Remember, money-saving tips aren't about being stingy; they're about making your money work smarter. Whether it's learning how to save money from your salary or spending limited money where it's most needed, every small decision you make now will affect your future financial situation.

How to Save Money: 10 Pitfalls to Avoid

Saving money is straightforward in theory, but often derailed by avoidable mistakes. Recognising these traps and learning how to avoid them can completely switch the way you manage your money. Here are 10 common mistakes that will cost you, plus several practical tips to help you stay on track with your savings goals.

1.Skipping the Budget Blueprint

If you want to save money, you need to have a clear account and lay a good foundation. If you don't keep an eye on how your money is earned and spent, you'll likely exceed your budget in areas that you wouldn't normally pay attention to. For example, a regular subscription ($15 per month for streaming and $10 for the app) could add up to hundreds of dollars a year. Use a free tool such as Google Sheets or a budgeting app to plot and chart your cash flow. First, assign the money to the things that must be used every day, and then arrange several things that you usually want to buy. At the same time, it puts saving money in the most critical position, which is non-negotiable.

2.Surrendering to Impulse Purchases

Unexpected expenses in life, whether it's a sudden discount promotion at a store or you want to eat snacks when you're hungry, will make people unable to control the urge to spend money. To combat this, implement a 24-hour “cooling off” policy: Take a day off before buying non-essential items. Most impulsive thoughts will decline, saving money for more meaningful things, like taking a vacation or paying off debt.

3.Overlooking High-Interest Debt

If your credit card interest rate is over 20%, it will rise much faster than the interest on a regular savings account. It is recommended to pay off those high-interest debts first, and then worry about low-interest loans like student loans. Paying even $50 more per month on a $3,000 balance can save hundreds of dollars in interest over time and help them save more quickly.

4.Ignoring Emergency Savings

Because they have no emergency reserves, they can only rely on credit cards or loans to survive in a crisis, which makes them easily fall into a debt cycle. I thought that I should at least save $500 first, and then work hard to cover three months of living expenses. You can set up an automatic transfer of $20 to $50 each week to make saving money simple.

5.Delaying Retirement Contributions

Waiting even a few years to start saving for retirement could cost them thousands of dollars by eliminating the benefits of compound interest. For example, if you start saving at age 25 instead of 30, you might have an extra $200,000 by the time you retire, assuming an annual return of 7%. Contribute as much as possible to your employer's plan (like a 401(k)) so that you can get the full matching benefit - this is free money, so don't waste it.

6.Misusing Savings Accounts

Putting money that you need urgently or save for the long term in an account with a very low interest rate (like 0.01%) will make the money less and less valuable because of inflation. Now you can put your money into high-interest accounts or certificates of deposit (CDS) with an annualised yield of 4-5% APY to make your money earn more income. Check out your options with a bank such as Ally or Capital One.

7.Overcomplicating Savings Strategies

Complex systems, such as tracking 20 spending categories, often fail because they’re just too hard to stick to. Use the 50/30/20 rule to keep it simple: spend 50% of your income on needs, 30% on wants, and 20% on savings or to pay off debt. Adjust ratios to fit your lifestyle, but try to keep the model simple so it can be sustained.

8.Neglecting Small Wins

Dismissing minor savings as insignificant ignores their cumulative impact. If you brew coffee at home, it can save you $150 a month, which comes to $1,800 a year. Redirect these “invisible” savings to achieve critical goals, like paying off debt or making investments.

9.Cosigning Loans Unwisely

If you agree to guarantee a loan for a relative or friend, you will be held legally responsible if they default. This risk can strain relationships and credit scores. If you decide to help others, it is recommended to write down the conditions for your help and state them clearly, or simply give the other person a lump sum of money.

10.Failing to Reassess Habits

Once your life circumstances change, like getting a promotion, losing a job, or suddenly having more expenses, you have to readjust your financial plans. Review spending and goals quarterly. Now that your salary has increased, does that mean you can save more money? Are car repairs eating up your spare cash? Adjust your plans to match your priorities.

Mastering how to save money hinges on avoiding these pitfalls through awareness and proactive habits. Start by automating your reserve requirements, then tackle high-interest debt, and then monitor your spending for a month to see if there are any gaps. Small, steady changes, such as renegotiating invoices or resisting making random purchases, can add up to impressive results. You should understand that you don’t have to pursue perfection; continuous enhancement is the most critical thing.

How to Save Money from Salary

Saving money can be difficult for everyone, especially when various expenses are competing to spend every penny. Whereas, with a little preparation and several adjustments, you can turn your salary into a solid savings machine. The following are practical tips that can help you make saving money a priority without having to put yourself in a difficult position. You can spend as much as you want.

Start with a Spending Framework

The cornerstone of how to save money from salary lies in proactive budgeting. It is best to assign all funds in advance and not leave any remaining money without a plan. A technique that everyone knows is the 50/30/20 rule: spend 50% of your net income on needs, 30% on optional expenses, and 20% on savings and debt repayment. If fixed expenses exceed half, you need to reduce several flexibly adjustable expenses, like cooking at home instead of eating out all the time, so that the proportion can be adjusted. This method puts savings first, not as a last-minute consideration but as the first thing to consider.

Automate Financial Priorities

Human willpower is fallible; automation isn’t. Set up automatic transfers so that every time you get paid, a portion of it goes directly into your nest egg or investment account. For example, you can set up an automatic transfer the next day after receiving your salary to transfer 10% of your income, so that you can secure that it is done every time. Apps such as Digit or your financial institution’s built-in tools can make the process simpler and help you achieve your goals more easily. Over time, these automation results slowly accumulated, eventually turning a small portion into a considerable reserve.

Audit Recurring Expenses

Monthly subscriptions and memberships, such as streaming platforms, gyms, delivery apps, etc., often eat into your income without you realising it. These costs need to be evaluated every six months. You can close services that are not used frequently, negotiate prices with providers to cut costs, or move to cheaper alternatives. Putting $30 of your unused membership fee into savings each month adds up to $360 a year — an easy way to save money quickly without drastically cutting back on your spending.

Leverage Side Income Streams

Supplementing your salary accelerates savings potential. Consider freelance work, part-time gigs, or turning a hobby such as photography or crafts into a profitable business. Platforms such as Upwork or Etsy make it easier for you to find clients and customers and to communicate directly with them.

If someone knows website design or AI website development, tools such as Wegic can offer them an easy way to create a professional website that showcases services or sells products. This extra income can be earmarked exclusively for savings, helping you reach goals faster.

Resist Lifestyle Inflation

Climbing wages or giving bonuses often makes people want to spend more money. They can put several of their newfound earnings directly into a savings account. If your salary grows by 5%, commit 2-3% to savings and use the rest to enjoy life. This balance prevents lavish spending from affecting your long-term financial stability.

Regularity is more critical than perfection. You can start with a simple approach, like setting up automatic deposits or carefully checking what services you have subscribed to, and then gradually use other approaches. Listen up! Saving money from your paycheck doesn't have to be a drastic switch; small, thoughtful decisions can have long-term benefits. By prioritising savings as a fixed expense and optimising how they spend their money, they can build a solid financial foundation even if they don't earn much.

How to Track Expenses and Allocate Funds for Savings

Effective financial management starts with transparency, which means knowing where your money is going and directing its flow in a planned way. Here's a simpler trick to fix this, perfect for those of you who want to know how to save money from your salary or how to make your limited income more.

Step 1: Document Every Transaction

Start by writing down all acquisition switches, no matter how small they are. Use free apps such as Mint or You Need A Budget (YNAB) to automatically keep track of your expenses, or just write down your expenses in a notebook. This accounts for habits such as frequently ordering takeout or impulsive online shopping that can eat into your budget. For example, if you find that you spend $75 per month on coffee, you could quickly save money by making your coffee at home.

Step 2: Categorise Spending

Divide your expenses into some categories: one is necessary spending, like rent and food; one is spending whenever you want, like entertainment and eating out; and the other is saving. This makes the point clear. If necessities take up 70% of your income, adjust your discretionary spending to free up money. Even if you spend 5% less on unnecessary things, you can save hundreds of dollars a year and use that to pay off debt or save for an emergency.

Step 3: Assign Savings First

Treat savings as a fixed expense. Allocate 10–20% of each paycheck to savings immediately after receiving income. Automating this step ensures consistency, removing the temptation to spend first and save later—a key strategy for clever ways to save money on any income level.

Step 4: Review and Adjust

Treat saving as a fixed expense. As soon as they get their salary, they put 10-20% into a savings account. Automating this process can help keep things more regular and avoid the urge to spend first and save later, which is an essential strategy for saving money, no matter how much you earn.

Take a look at your spending each week. Are there any unexpected extra expenses that crop up? Haven’t they invested enough time and energy in a certain area? Transfer any extra money to a savings account or use it to reduce debt. For example, if you save $50 on groceries, you can make your emergency reserve more sufficient.

By diligently monitoring and prioritising savings, they turned vague ideas into real advancement, demonstrating that saving money is not just about spending sparingly, but also about doing it clearly and regularly.

Let Wegic Turn Your Savings into Side Hustles

Now that you know how to save money, why not try to make more money? Just think of it as chatting with a friend, except this friend can come up with a super simple website for you, though you’re brainstorming. It’s Wegic: an AI tool that turns ordinary chats into no-code websites, without the need for any programming knowledge. Whether you want to start a blog to share budgeting tips or sell handmade crafts, the AI-powered website builder Wegic will take care of the technical aspects so you can focus on making and saving more money. Do you want to turn those money-saving tips into ways to make money? Together, they were going to create something prominent.

Written by

Kimmy

Published on

Apr 28, 2025

Share article

Read more

Our latest blog

Other

Feb 24, 2026

How Freelance Business Analysts Use Data Visualization Portfolios to Justify High Daily Rates

Other

Feb 24, 2026

How Independent Food Scientists Use Compliance Blogs to Attract Emerging Food Brands

Other

Feb 24, 2026

How Freelance Cloud Architects Use Service Packaging to Productize Complex Consulting

Webpages in a minute, powered by Wegic!

With Wegic, transform your needs into stunning, functional websites with advanced AI

Free trial with Wegic, build your site in a click!