Log in

Build Your Site

Top 7 TransferNow Alternatives for Seamless Money Transfers

Explore the top 7 TransferNow alternatives for seamless money transfers. Compare fees, speed, and security to choose your perfect platform in 2025.

Tired of TransferNow limits or fees? Discover 7 brilliant alternatives offering smoother, cheaper, and faster global transfers.

If you’ve ever read a TransferNow review, you’ll know it’s a solid choice for sending money online—but it’s not the only game in town. Many users love how the TransferNow app simplifies sending funds, but others find its costs and transfer limits a dealbreaker for frequent or larger transactions. Luckily, fintech innovation has exploded in recent years, offering smarter ways to move your money worldwide without sacrificing speed or security.

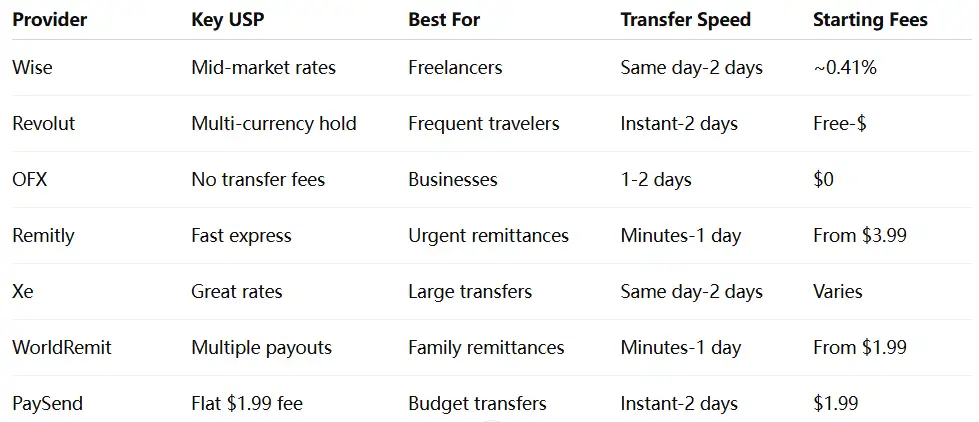

Below, check out a quick comparison of the top contenders ready to replace or complement your TransferNow experience. Dive in and find the right TransferNow alternative that fits for your personal or business needs!

Why Look Beyond TransferNow?

If you’ve been exploring ways to send money online, chances are you’ve stumbled upon a TransferNow review or two praising its convenience and user-friendly platform. Indeed, the TransferNow app makes sending funds simple for personal users, and for many people, it does the job well. But as with any financial service, no single tool fits everyone perfectly — and that’s where frustrations sometimes creep in.

Here’s why some users start searching for a TransferNow alternative:

Fees for Higher Amounts

While TransferNow offers free transfers up to certain thresholds, fees can quickly rise for larger sums. Individuals or businesses moving significant amounts often discover that TransferNow’s pricing model eats into their bottom line. In a competitive market where other services boast lower fees or better exchange rates, it’s natural to wonder if you could be saving money elsewhere.

Transfer Speed

Speed is everything when you’re sending funds urgently — for family support, business payments, or emergency situations. While the TransferNow app processes many transactions fairly quickly, it’s not always the fastest in the industry. If immediate delivery is your top priority, you might find faster options among newer fintech providers that specialize in instant transfers.

Limited Corridors

Another sticking point is the geographic reach of TransferNow’s services. While it covers a solid range of popular corridors, users sometimes find it’s missing coverage in specific countries or regions where they have personal or business ties. For people with global lifestyles — or businesses trading across borders — this can be a significant limitation.

Lack of Business-Focused Tools

The TransferNow app is primarily built with personal users in mind. It’s easy and clean, but businesses often need more robust features: things like multi-user permissions, batch payments, accounting integrations, or specialized FX tools. Companies transferring salaries, vendor payments, or bulk international invoices may prefer a platform designed specifically for commercial needs.

How to Choose the Right Transfer Alternative

The good news is that your options have never been better. The rise of innovative fintech services means there’s a perfect TransferNow alternative out there for virtually every user. But how do you pick the right one?

Below are the key factors to weigh when choosing your next money transfer partner.

1. Exchange Rates & Hidden Fees

It’s easy to get lured by claims of “zero fees” — but the real cost often hides in the exchange rate. Even if a service advertises a free transfer, it may mark up the currency conversion far above the mid-market rate. When reading any TransferNow review, pay close attention to how their rates compare to competitors, and do the same with any alternative.

2. Destination Countries

Not all services cover the same geographic footprint. Some focus heavily on certain regions (like Southeast Asia or Latin America), while others serve nearly every country worldwide. Make sure your chosen platform handles transfers to all your required destinations, or you’ll end up juggling multiple services unnecessarily.

3. Security & Compliance

Money transfers involve sensitive personal and financial data — and significant sums of money. Look for providers licensed and regulated in reputable jurisdictions. Top services implement advanced security measures like encryption, two-factor authentication, and fraud monitoring. The TransferNow app takes security seriously, and you should expect no less from any alternative you consider.

4. Business vs. Personal Use

Consider whether you’re sending money as an individual or on behalf of a business. For personal use, simplicity and cost savings might top your list. For business users, it’s wise to prioritize platforms offering business accounts, integration with accounting software, bulk payment tools, and dedicated support. Some providers in our list below excel in serving freelancers and businesses looking for more than what the basic TransferNow app offers.

5. Ease of Use (App, Web, Integrations)

Finally, don’t underestimate the value of a slick user experience. A clunky website or a confusing mobile app can turn even the cheapest service into a headache. The TransferNow app has earned praise for being clean and straightforward — a key reason people stick with it. Any alternative worth considering should deliver equally smooth usability across both mobile and desktop, plus handy extras like rate alerts or API access for businesses.

Pro Tip: Always run a small test transfer when trying a new service. It’s the easiest way to ensure the process is smooth, fast, and transparent before you entrust larger sums to any new platform.

Quick “Decision Tree”

Is speed your #1 priority? → Try Remitly or WorldRemit.

Need low fees for large transfers? → Check OFX or Wise.

Business tools required? → Look at OFX or Revolut Business.

Sending money to less common countries? → Xe or WorldRemit may cover more corridors.

Prefer mobile simplicity? → PaySend or the Revolut app might suit you best.

Armed with this knowledge, you’ll be ready to explore the top 7 TransferNow alternatives that might fit your needs better — and possibly save you time and money in the process.

The Top 7 TransferNow Alternatives (Detailed Reviews)

Here’s a closer look at the best services worth considering if you’re searching for a TransferNow alternative. Each offers unique strengths—whether you want cheaper fees, faster speeds, or better tools than the TransferNow app provides.

1 Wise (formerly TransferWise)

Overview

Wise has become a giant in the world of low-cost international transfers. Instead of adding hidden markups to exchange rates, they use the real mid-market rate and charge a transparent fee.

Best for:

-

Sending money with the lowest possible currency conversion costs

-

Freelancers or remote workers getting paid globally

Pros:

-

Very low fees and excellent rates

-

Transparent pricing

-

Easy-to-use website and mobile app

-

Multi-currency account available

Cons:

-

No cash pickup option

-

Not ideal for cash-based remittances

Example fee scenario ($1000 transfer):

-

Sending $1000 from the U.S. to EUR could cost around $4.11 in fees (0.41% average) plus mid-market rate.

2 Revolut

Overview

Revolut started as a digital banking app and now offers competitive international money transfers. Users can hold and exchange dozens of currencies and send funds quickly worldwide.

Best for:

-

Frequent travelers

-

People wanting a banking app plus transfers in one place

Pros:

-

Competitive exchange rates

-

Multi-currency wallets

-

Handy budgeting and analytics tools

-

Free transfers up to a monthly limit on some plans

Cons:

-

Fees kick in above certain limits

-

Customer support sometimes slow during busy periods

Example fee scenario:

-

Sending $1000 from the U.S. to GBP might be free under your monthly quota, then around 0.5–1% fee thereafter.

3 OFX

Overview

OFX is ideal for people or businesses moving larger sums. Unlike the TransferNow app, it specializes in significant transfers, offering personal service and strong foreign exchange expertise.

Best for:

-

Large transfers ($10,000+)

-

Business payments and FX risk management

Pros:

-

No transfer fees

-

Excellent rates for high-value transfers

-

24/7 customer support

-

Business-focused tools available

Cons:

-

Minimum transfer amount often $1,000

-

Slower than instant services for small amounts

Example fee scenario:

-

Sending $1000 might not incur fees, but the exchange rate margin is roughly 0.5–1%, varying by currency.

4 Remitly

Overview

Remitly is famous for speed and cash pickup options. Unlike the often purely digital experience in many a TransferNow review, Remitly caters heavily to remittances for family support worldwide.

Best for:

-

Urgent remittances

-

Cash pickups and mobile money

Pros:

-

Instant delivery in some corridors

-

Multiple payout methods (bank, cash, mobile wallets)

-

Easy mobile app

Cons:

-

Higher fees for express options

-

Limits on daily or monthly transfer volumes

Example fee scenario:

-

Sending $1000 from the U.S. to the Philippines might cost around $3.99 in economy mode or $9.99 for instant delivery.

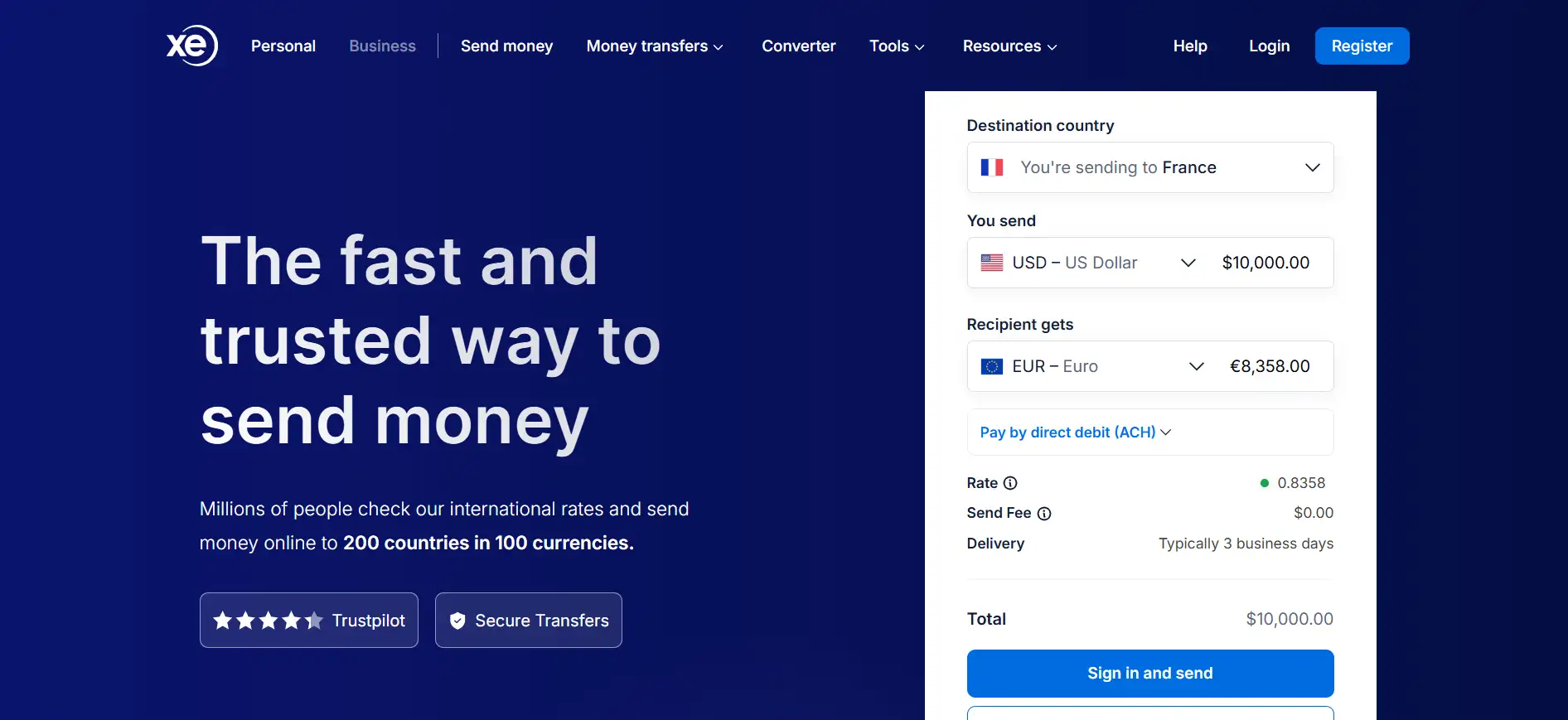

5 Xe Money Transfer

Overview

Xe, once known mainly for currency exchange rate data, now operates a strong money transfer service. It’s a solid TransferNow alternative for both individuals and businesses moving various sums globally.

Best for:

-

Mid-to-large transfers

-

People who value competitive rates without a flashy app

Pros:

-

Competitive exchange rates

-

No transfer fees on many corridors

-

Good for large transactions

Cons:

-

Slower transfer speeds than some fintech rivals

-

App design feels a bit dated

Example fee scenario:

-

Sending $1000 USD to AUD might incur no fees, but a 0.5–1% exchange rate margin applies.

6 WorldRemit

Overview

WorldRemit specializes in flexible payout options—including cash pickups, bank deposits, and even mobile airtime top-ups—making it a favorite among users who prefer more than bank-to-bank transfers.

Best for:

-

Remittances to family or friends

-

Users needing cash pickups or mobile wallets

Pros:

-

Fast transfer options

-

Vast global reach

-

Multiple payout methods

Cons:

-

Fees vary significantly by country

-

Higher costs for cash pickups

Example fee scenario:

-

Sending $1000 to Kenya for cash pickup might cost about $5.99 plus exchange margin.

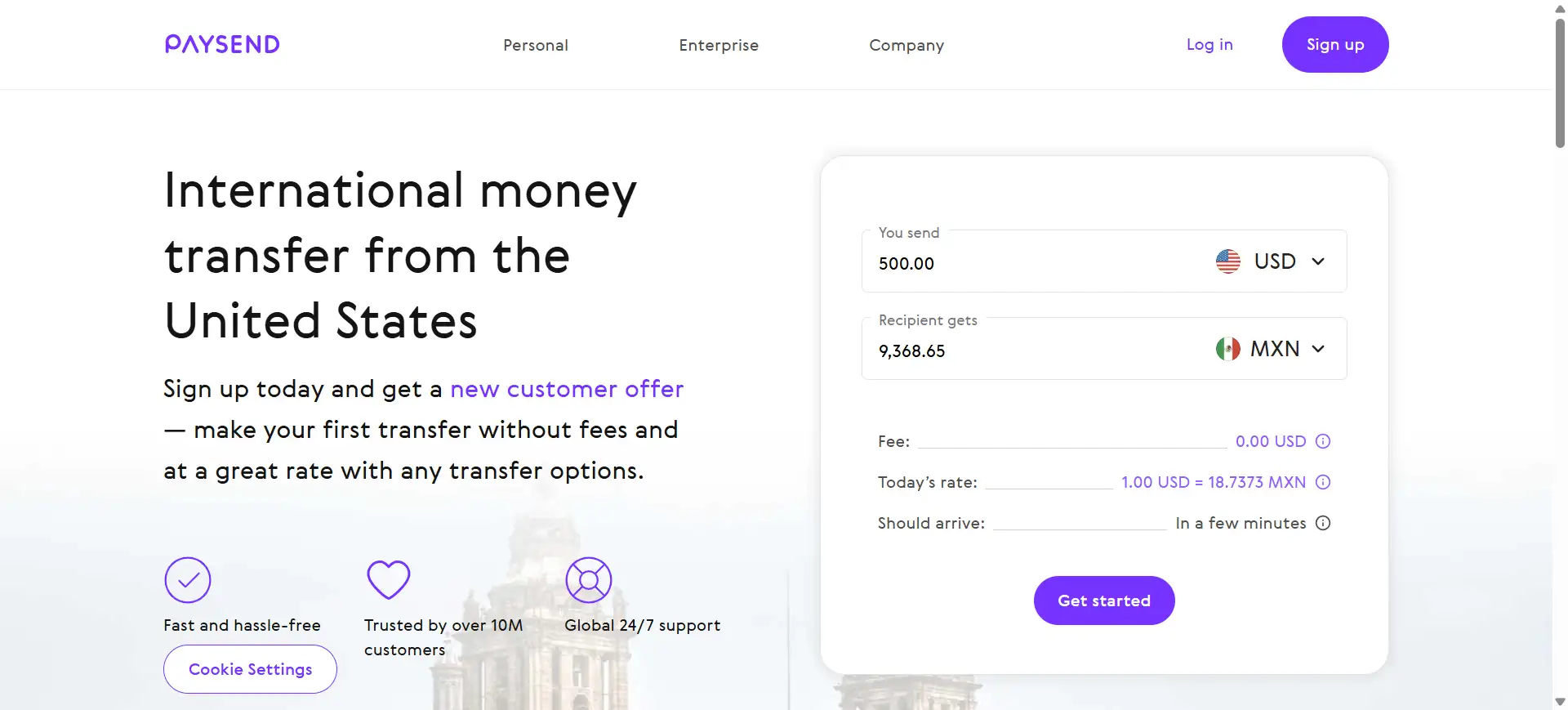

7 PaySend

Overview

PaySend has gained popularity for simple flat-fee transfers. Compared to the more variable costs seen in a typical TransferNow review, PaySend’s “$1.99 anywhere” approach appeals to budget-focused senders.

Best for:

-

Low-cost personal transfers

-

People who value simplicity over complex pricing

Pros:

-

Flat $1.99 fee for many transfers

-

Simple mobile interface

-

Instant delivery in many corridors

Cons:

-

Exchange rate margin can be higher than mid-market

-

Not ideal for large business transfers

Example fee scenario:

-

Sending $1000 from the U.S. to India might cost a flat $1.99, plus a slight exchange margin.

If you’ve been relying solely on the TransferNow app, exploring these alternatives could help you save money, speed up delivery, or expand your options. Each service shines in different areas, ensuring you can find the perfect match for your specific transfer needs.

Which TransferNow Alternative is Best for You

Choosing the right money transfer service isn’t just about fees—it’s about what fits your life or business best. Here’s how to match your needs to the perfect TransferNow alternative:

- Freelancers → Wise

If you’re a freelancer working with international clients, Wise is your best friend. You’ll enjoy low fees, mid-market exchange rates, and multi-currency accounts to receive payments like a local in dozens of countries.

- Businesses → OFX

Running a business and making high-value transfers? OFX delivers better rates for large sums, expert support, and specialized business tools that go far beyond the standard TransferNow app features.

- Speed-focused → Remitly

Need funds delivered instantly? Remitly specializes in fast transfers, cash pickups, and mobile wallet deposits, making it ideal for urgent personal remittances.

- Budget-conscious → PaySend

On a tight budget? PaySend offers a flat $1.99 fee on many routes, giving you simplicity and savings for everyday transfers without surprises.

Ready to move your money smarter? Compare today’s rates and save.

FAQ

Is TransferNow safe?

Yes, TransferNow is generally safe. It uses secure encryption and follows strict regulatory standards to protect your personal and financial data. Many people highlight this in a positive TransferNow review, noting that the service is reliable for personal transfers. However, always verify that you’re on the official website or TransferNow app to avoid scams or phishing attempts.

What’s the cheapest TransferNow alternative?

If you’re looking for the cheapest TransferNow alternative, Wise often comes out on top thanks to its transparent fees and mid-market exchange rates. PaySend is also a solid low-cost option with its flat $1.99 transfer fee in many corridors. That said, the cheapest provider can vary depending on the countries you’re sending to and the amount you’re transferring, so it’s wise to compare real-time rates before sending money.

Can I send large business payments with alternatives?

Absolutely. Many TransferNow alternative services cater specifically to businesses. OFX, for example, specializes in high-value business transactions, offering competitive rates and business-specific tools like FX risk management and batch payments. These features often go far beyond what’s available in the standard TransferNow app.

How fast are TransferNow alternatives?

Transfer speed varies widely among alternatives. Some services, like Remitly, can deliver funds within minutes for certain corridors. Others, like OFX, might take 1–2 business days, especially for larger sums. Generally, newer fintech options can be significantly faster than traditional banks and may outpace TransferNow for urgent transfers.

Conclusion

TransferNow is good—but the world of online transfers has so much more to offer. Explore your options and keep more money in your pocket.

Whether you’re chasing speed, lower fees, or business-friendly tools, choosing the right provider can transform your money transfer experience. Don’t settle—find the TransferNow alternative that’s perfect for you!

Written by

Kimmy

Published on

Jul 3, 2025

Share article

Read more

Our latest blog

Webpages in a minute, powered by Wegic!

With Wegic, transform your needs into stunning, functional websites with advanced AI

Free trial with Wegic, build your site in a click!