Are you still struggling with razor-thin profits, customers who don't return, and the lack of reliable support to manage your website? In today's fiercely competitive market, where costs continue to rise, many small business owners face the same challenge: how to keep their business profitable in the long run. Put simply, the question of "

how can a small business owner be successful" is not abstract. It touches every part of the business, from finances and operations to customer growth.

Profitability isn't just about selling more. It's a comprehensive process: you need steady margins, healthy cash flow, scalable operations, and a constant flow of both new and repeat customers. In this article, we'll break down 12 proven, practical strategies across three areas — finance & pricing, lean operations & efficiency, and growth & customers — to help you build a business that is stronger, faster, and more profitable.

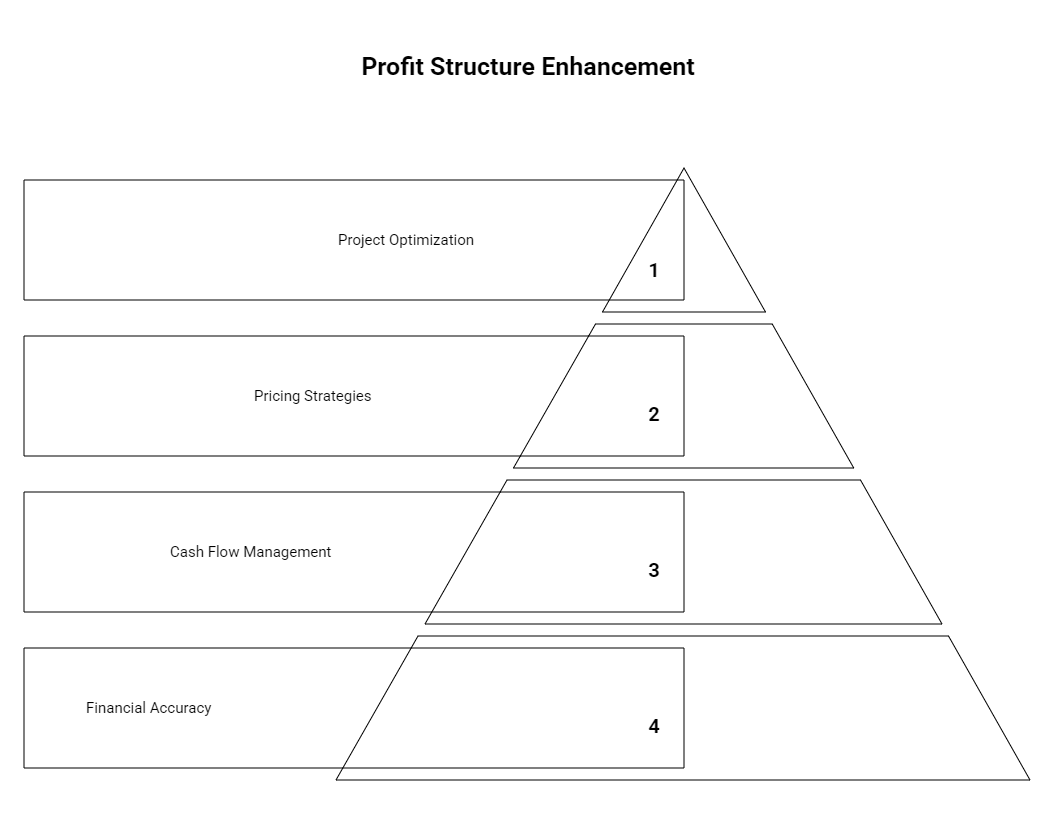

The first step toward profitability, and answering the question of "how can a small business owner be successful," is to understand your numbers, measure them accurately, and ensure you can collect the money. Many small business owners get caught up in daily operations and overlook basic financial health checks — often the hidden reason why revenue grows but profits keep shrinking.

1.Get the Numbers Right: Gross Margin, COGS, and Unit Economics

No matter if you run a café, an online store, or a local service business, gross margin is the cornerstone of profitability. Profit is not a matter of "gut feeling" — it's pure arithmetic. Every small business should adopt a unit economics mindset: calculating real profit per item, per order, or customer.

First, break down your COGS (Cost of Goods Sold), making sure raw materials, packaging, labor, logistics, and platform commissions are all counted as direct costs.

Second, calculate unit gross margin and gross margin percentage, and compare results across products, sales channels, and customer groups.

Third, factor in customer acquisition cost (CAC) and after-sales costs to reveal the true contribution margin per order or customer.

This way, you can finally answer key questions: which SKUs are profitable? Which sales channels may generate quick orders but silently drain your margins? Take a 25 RMB coffee as an example: beans and cup lid cost 5 RMB, rent and labor allocation 6 RMB, delivery platform 5 RMB, marketing 2 RMB. On paper, it looks like a 7 RMB margin — but after discounts and refunds, you may only be left with 4 RMB. Reviewing these numbers monthly can quickly expose the trap of high sales but low profits, helping you focus on high-contribution products and customers with strong lifetime value (LTV), which is the foundation to

increase profits for small businesses.

Too often, business owners only realize at year-end that their gross margins have been declining for months. A simple fix is to maintain a basic gross margin sheet, update it every month, and track the margins of different products or services. With timely visibility, you can adjust pricing or product mix before profits erode.

2.Prioritize Cash Flow: The Rolling 13-Week Forecast

For small businesses, the most common cause of collapse isn't a lack of orders — it's a cash flow crunch.

A rolling 13-week cash flow forecast is one of the most practical tools you can use:

Track projected income and expenses week by week for the next 13 weeks.

Update regularly to spot cash gaps early and prepare countermeasures such as promotions, faster collections, or financing.

When combined with an accounts receivable aging report and inventory turnover analysis, this tool becomes even more powerful. You may find that speeding up turnover by just 10 days can add an extra point to your profit margin. On the other hand, reckless expansion, stockpiling inventory, and delaying reconciliations are often the hidden culprits behind disappearing profits. The best part? You don't need fancy software — a simple Excel sheet or Google Sheet will do the job, and it's a proven method for "how can a small business owner be successful" in maintaining stability.

3. Dynamic Pricing and Value-Based Pricing

Your pricing should never stay static. Instead, it should

adapt to costs, competition, and the value customers perceive.

Dynamic pricing: adjust prices based on seasonality, inventory pressure, or raw material cost fluctuations.

Value-based pricing: price according to customer-perceived value rather than cost alone — for example, by offering add-on services, extended warranties, or personalized options.

Dynamic pricing lets you respond flexibly to changes in inventory, demand elasticity, seasonality, costs, and competition. Value-based pricing, on the other hand, anchors pricing around the value customers see, not just a simple cost-plus formula.

4.Cut the "Pet Projects": Stop Unprofitable Product Lines

The 80/20 rule couldn't be more relevant for small businesses — in most cases, 20% of products drive 80% of profits. To protect profitability, set clear stop rules: if a product category's gross margin stays below target for three consecutive months, if capital is tied up beyond a warning threshold, or if repurchase rates consistently underperform, it's time to phase it out or scale it down.

Applied with the 80/20 rule, you'll likely discover that just 20% of your SKUs deliver the bulk of your profits, while the long tail not only underperforms but also drags down supply chain efficiency, warehousing, and after-sales. Profitability isn't about doing more — it's about doing the right things well, and channeling resources into the areas that deliver the greatest returns, which is essential if you want to become a successful business owner.

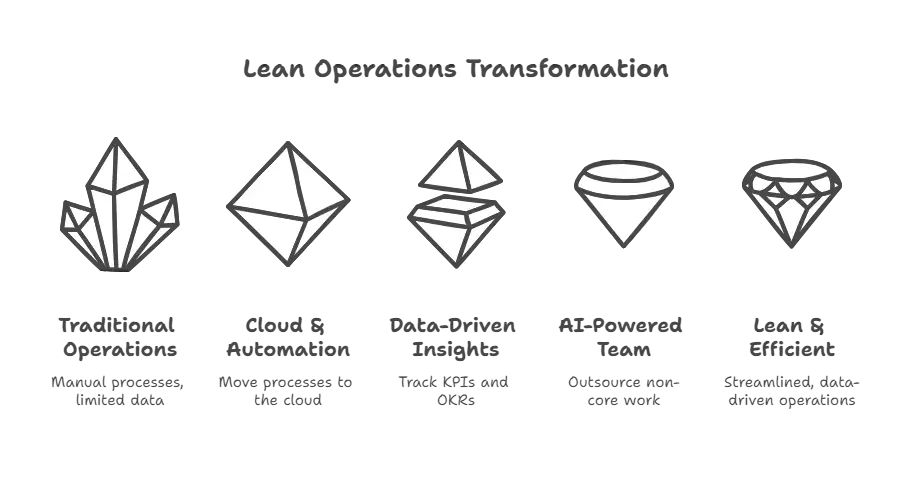

Part B | Lean Operations and Efficiency: Driving Growth Through Systems and Automation

If finance is the "lifeblood" of a small business, operations are its "circulatory system." The healthier and more efficient your operations, the easier it is to achieve Small Business Growth at a lower cost.

5.Move Processes to the Cloud and Automate (with AI)

Efficiency translates directly into profit. Start by mapping out your workflows — from lead acquisition to quotation, to order placement, fulfillment, and after-sales. Highlight the repetitive, error-prone, and standardizable steps, and then move them to the cloud and automate them. Best practices include:

Automatically syncing form submissions into your CRM;

Automatically generating quotes and contracts with templates and e-signatures;

Keeping customers updated with automated shipping status notifications;

Logging and reviewing after-sales tickets automatically.

Digitization and automation are among the most effective ways to cut operating costs. As a one-stop AI website partner, Wegic can help you build a no-code corporate website or marketing landing page, auto-generate and refresh content, and connect forms with intelligent customer service — all while significantly reducing maintenance costs.

Click here to try Wegic

6.Be Data-Driven: Dashboards and Key Metrics (KPI/OKR)

No data, no management. Every business, no matter the size, should maintain an operations dashboard that's clear and easy to understand. At a minimum, it should track:

Review trends weekly and run attribution and hypothesis tests monthly. If traffic is up but conversions are falling, is it due to declining channel quality or poor page experience? If repeat purchases are down, is it caused by supply shortages or slow service response times? Pair this with cohort analysis, tracking retention curves by first purchase month, channel, store, or product line, to identify your truly loyal customers — a vital part of "how can a small business owner be successful" in the long run.

7.Outsource Non-Core Work and Build an AI-Powered Team

For small businesses, "too much to do with too few people" is the norm. The solution is to focus scarce human resources on the areas where they create the most value. Outsource non-core tasks — such as bookkeeping and taxes,

graphic design, video editing, or peak-hour customer service coverage — with clear SLAs and performance standards, handing off overflow capacity to external partners.

At the same time, leverage AI tools to build an AI-powered virtual team. Let AI handle repetitive tasks like customer support, content generation, and basic design, so your real team can focus on what truly drives small business growth.

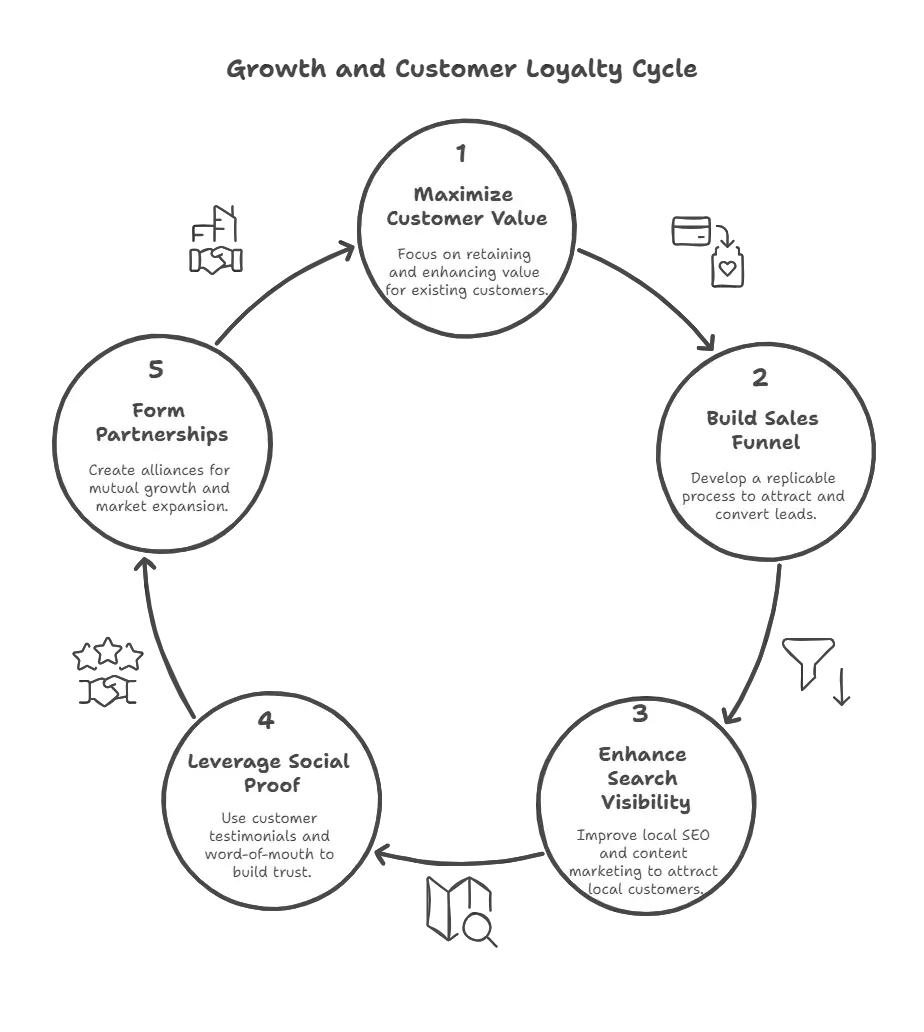

Part C | Growth and Customers: Low-Cost Acquisition & High Customer Loyalty

Profitability isn't just about cutting costs — it's about keeping customers coming back, and making them your best source of new referrals.

8.Maximize the Value of Existing Customers (Retention First)

Retention is the most cost-effective growth strategy. Start by asking two key questions: Why do customers return? And why do they recommend you to friends? The answers to these are at the heart of retention and referrals.

Practical steps include:

Design a lifecycle journey that delivers nurturing and educational content at 3, 7, and 30 days after the purchase, lowering the barriers to a second purchase.

Introduce subscription or maintenance plans, or annual service packages, turning one-off revenue into predictable cash flow;

Build upsell and cross-sell triggers — for instance, 48 hours after delivering a main product, prompt customers to consider high-margin accessories or extended warranties;

Refine customer experience details that drive repurchases — faster response times, clearer commitments, delightful unboxing, and responsive after-sales service;

Create membership tiers and benefits for your most loyal customers, ensuring the top 20% feel rewarded with exclusive perks that match their value.

By using "Customer Lifetime Value (LTV) ≥ 3× Customer Acquisition Cost (CAC)" as your guiding benchmark, you can fine-tune marketing rhythms, increase profits for small businesses, and watch profit margins rise alongside repeat purchase rates.

9.Build a Replicable Sales Funnel

Sustainable growth doesn't come from flashes of inspiration — it comes from a sales funnel you can replicate. From lead generation (TOFU) → engagement (MOFU) → conversion (BOFU) → repeat purchases/referrals, every stage should have clear touchpoints and actions:

TOFU: capture interest with content and ads, such as local guides, checklists, and comparison reviews;

MOFU: reduce uncertainty with trials, samples, or in-store experiences;

BOFU: remove final doubts with social proof, limited-time offers, and money-back guarantees;

Post-sale: within 7 days, launch a welcome journey and second-purchase trigger to turn customer satisfaction into repeat purchases and positive reviews.

Track conversion rates, dwell time, and common objections in your CRM. Support execution with standard scripts and asset libraries, and run a monthly funnel analysis to pinpoint bottlenecks — whether it's poor lead quality, unclear pricing, or a slow

checkout page. Once your funnel consistently delivers "8–12 conversions per 100 leads," you'll have built the foundation to

become a successful business owner with predictable returns.

10.Localize and Boost Search Visibility (Local SEO & Content Marketing)

For local service-based small businesses, Local SEO is one of the most cost-effective ways to acquire new customers:

Optimize your Google My Business (GMB) profile, ensuring NAP (Name/Address/Phone) is consistent across your website and directories, and keep business hours, holiday schedules, and store photos up to date.

Implement a review strategy: request reviews within 72 hours of purchase, and respond to negative feedback within 24 hours with concrete solutions.

Build content clusters focused on user needs and pain points — including local guides, price comparisons, case studies, and FAQs — and support them with structured data (FAQ/LocalBusiness/Review) to maximize visibility;

Ensure pages load quickly, are mobile-friendly, easy to read, and feature clear, prominent CTAs.

With Wegic, you can launch

SEO-friendly landing pages and topic pages in just one minute. The system automatically generates FAQs, outlines, and metadata, with support for structured data and sitemaps. For future campaigns or product launches, Wegic handles updates automatically, preventing customer loss from outdated information. This allows small businesses to maintain a steady stream of content and search visibility without hiring extra staff, directly supporting "

how can a small business owner be successful" through visibility and local trust.

11.Social Proof and Word-of-Mouth Growth

Customer trust is built on what others say about you. That's why it's essential to systematize your approach to social proof:

Create a case study library — each story should include the customer background, the problem, the solution, the outcome, and quantifiable results (e.g., cost savings, faster delivery, higher conversion rates);

Collect diverse forms of proof: ratings, screenshots, long-form reviews, videos, unboxing photos, media coverage, and industry certifications;

Showcase this proof at key decision points, such as pricing pages, beside inquiry forms, and in the hero section of ad landing pages.

Launch a referral program with clear, trackable rewards for existing customers (discounts, points, joint gifts), and use unique referral links to measure contributions.

Always prioritize compliance and authenticity. Every piece of proof should be traceable. Rather than exaggerating, focus on presenting clear before-and-after comparisons and third-party endorsements. When executed properly, the same amount of traffic can drive higher conversion rates and lower acquisition costs.

12. Partnerships and Alliances: Creating Win-Win Growth

Once you clearly define your customer profile, you'll notice that many non-competing brands are serving the same audience. This is where partnerships and alliances become powerful.

Practical steps include:

Select complementary partners (e.g., gyms with healthy meal services, pet shops with photography studios, cleaning services with hardware stores);

Design joint product bundles and cross-promotion mechanisms, such as in-store/website recommendations, joint event days, and cross-store loyalty points;

Set revenue-sharing terms and clear targets, using tracking links and unique redemption codes to measure contributions, ensuring accountability;

Co-create content — such as joint reviews, checklists, or livestreams — to build authority and share audiences;

Run quarterly reviews to analyze conversions, average order value, and repeat purchases, eliminating underperforming partnerships and scaling the successful ones.

At its core, alliances are about leverage. By tapping into another brand's trusted network at a fraction of the cost, you can dramatically boost acquisition efficiency, while gaining customers who are higher-quality and more loyal, paving the way to becoming a successful business owner.

Frequently Asked Questions (FAQ)

Q1: Why is revenue growing, but profits are not?

The three most common reasons are:

Structural margin decline, new sales are concentrated in low-margin products or high-discount channels;

Hidden operating costs, after-sales repairs, additional logistics fees, and inventory holding costs or losses are not fully accounted for.

Declining marketing efficiency, customer acquisition costs (CAC) are rising, while unqualified traffic is increasing.

The solution is to go back to unit economics: calculate the contribution margin of each channel, each SKU, and each customer segment. Identify the profit-draining gaps, correct them with dynamic pricing and portfolio optimization, and use process automation to reduce repetitive labor and rework costs. If necessary, cut "pet projects" that don't make money. Do this, and you'll quickly see profit margins rebound and achieve steady s

mall business growth.

Q2: Under competitive pressure, should I fight a price war?

Price wars are a short-term fix that causes long-term damage. While they may drive sales temporarily, they erode brand value and service quality, which ultimately hurts retention and reputation. Instead, focus on value-based pricing and highlight what makes you different, since mastering pricing strategies is how you become a successful business owner without relying on price wars.

Q3: Should small businesses use AI tools?

Absolutely. AI tools save time, cut costs, and enhance customer experience. For example, Wegic's AI-powered website growth platform lets you launch a no-code website in just one minute, automatically generate content and marketing pages, and integrate intelligent customer service and analytics, making digital adoption a practical step in "how can a small business owner be successful".

Click here to try Wegic

Q4: With a limited budget, should I prioritize ads or content/SEO?

If you need quick results or want to validate your funnel, ads are the faster option. But avoid spending without building lasting value. The best strategy is to combine ads with content/SEO: ad performance data shows which messages and value propositions work best, then turn those insights into content clusters, FAQs, and case studies to create long-term assets. With Wegic, you can generate and publish topic pages in minutes, and the system will automatically manage updates to keep your content fresh — boosting organic traffic and conversions over time.

Concluison

How can a small business owner be successful? The answer isn't a short-lived surge, but the ability to sustain a healthy profit structure over time and continuously increase profits for small businesses. Covering everything from finance and operations to customer growth and brand building, these 12 strategies will help you stabilize cash flow, boost margins, and expand your customer base.

Now, let the

Wegic AI Website Team help you take the first step — launch a no-code website in just one minute, with auto-updated content, built-in AI customer support, and growth tools that keep you profitable in today's competitive market.