Log in

Build Your Site

Best Retirement Plans for Small Business Owners (Solo 401k, SEP & More)

A 401(k) helps small business owners save for retirement and attract skilled employees. Discover more about the various plan options available.

Running your own business brings you a lot of freedom. However, it also comes with important responsibilities. One of the biggest responsibilities is planning for retirement. Small business owners need to choose the right retirement plan because it helps them save money for the future and can also provide valuable tax benefits. There are several retirement plans available. Picking the right one depends on your specific situation. The most common options include Solo 401(k), SEP IRA, and SIMPLE IRA. Understanding which plan works best for you is important. This article will focus on 401k for small business owners, especially if you're the sole employee. You will look at the main retirement options for small business owners. By finding the best retirement plan, you will be well-prepared for a comfortable future. Let’s dive into the best retirement strategies available for small business owners!

Solo 401(k): Super Saving Tool for Single Operators

A solo 401k for small business owners is the ultimate weapon for sole proprietors. It's designed for businesses without employees, including sole consultants, freelancers, and mom-and-pop shops. The solo 401(k) plan offers dual-status contributions. You contribute to the same account as both an employee and an employer.

The employee portion allows pre-tax contributions up to $22,500 in 2023. If you turn 50, you can make an additional $7,500 in "catch-up" contributions. The employer portion is even more powerful, allowing up to 25% of your business's net income. For example, $25,000 for an annual income of $100,000. The total annual limit is a whopping $66,000, far exceeding the $6,500 limit for regular IRAs. 401k contribution limits for small business ownersreach their peak with this plan. It is particularly suitable for high-income professionals.

Tax flexibility is its second biggest drawcard. It fully supports Roth 401k for small business owners. Choosing after-tax contributions doesn't reduce your current tax bill, but all earnings are tax-free upon retirement. This option is invaluable if you anticipate future tax increases. For example, if you plan to move to a high-tax state. Even better, you can split your contributions into pre-tax and Roth. This can achieve a strategic tax balance.

The best retirement plans for small business owners without employees often value their emergency financing feature. In the event of a business crisis, you can borrow 50% of your account balance or $50,000 (whichever is lower). You need to repay the loan over five years at an interest rate just 1% above the prime rate. This is faster and more flexible than a business loan.

Opening a Fidelity 401k for small business owners requires just three steps. Fill out the online application, sign the plan documents, and transfer the initial funds. Fidelity offers a zero-monthly fee plan with fund expense ratios as low as 0.015%. Annual management requires only filing Form 5500-EZ for account balances over $250,000. Investment options range from index funds to individual stock trading, giving you complete control.

However, be aware of two major restrictions.

- Full-time employees are prohibited. Part-time or contract workers are generally not affected.

- Employer contributions must be calculated accurately. Errors can result in a 10% IRS penalty.

It is recommended to use the IRS's online calculator or hire a CPA. If your business expands and you hire employees, you must terminate the plan that same year.

Click on the image to let AI boost your business 👇

SIMPLE IRA: Low-cost Solutions for Team-based Enterprises

If you have 1 to 100 employees, you should consider other plans of 401k for small business owners. SIMPLE IRA is one of the best retirement plans for small business owners with employees. Its name reveals its essence: Savings Incentive Match Plan for Employees. It provides team benefits with minimal management.

Employees make pre-tax contributions through payroll deductions. The base limit for 2023 is $15,500, with an additional $3,500 for employees over 50. The key difference is that, unlike a 401(k) for employees, employer matching is mandatory. You must choose between:

- Matching 100% of employee contributions (the first 3% of salary), or

- Making a non-elective contribution of 2% of all eligible employees' salaries.

For example, in the case of an employee who makes $50,000 annually:

- If you choose the 3% match, you'll have to match $1,500 if the employee contributes $1,500.

- If you choose the 2% non-elective contribution, you'll still have to contribute $1,000 even if the employee contributes nothing.

The rules for small business owners to participate are the same. However, your total savings potential is limited. You can't add to your employer's contributions like you can with a solo 401k for small business owners. The maximum annual savings limit is approximately $19,000, approximately $22,500 for those over 50. This is less than one-third of a Solo 401(k).

The key advantage is administrative costs. Setting up a SIMPLE IRA requires only filing Form 5304-SIMPLE (employee-selected broker) or Form 5305-SIMPLE (employee-designated broker). Annual filing is simplified to Form 5500, which takes less than an hour. Vanguard's SIMPLE IRA management fee is only $25 per account.

There are two trade-offs ofthe best retirement plans for small business owners with employees.

- Mandatory matching boosts employee loyalty. Data shows a 34% increase in employee retention for participating employees.

- Matching expenses exacerbates cash flow pressures during an economic downturn.

You can choose a 2% non-elective contribution. If the business is losing money and the employee's annual salary is zero, no contribution is required. Pay special attention to the transfer rules. Employees who have established a SIMPLE IRA for less than two years and roll over funds to a traditional IRA will trigger a 25% tax penalty. Planning your employee's career path ahead of time can help avoid this pitfall.

SEP IRA: Flexible Employer-led Plan

The best alternative for 401k for small business owners is undoubtedly the SEP IRA (Simplified Employee Pension). Whether you're a sole proprietor, a partnership, or a team of 50, it's available. The contribution potential is comparable to a solo 401(k). The 2023 cap is 25% of net income, or $66,000. For example, a design studio with $300,000 in annual revenue can contribute $75,000, but the cap is $66,000. 401k contribution limits for small business owners are equally impressive, but the logic is completely different. Only employers can contribute. Employees can't make their own contributions. Contribution rates must be the same for all if there are eligible employees.

Eligible employees are defined as those who are 21 or older, have worked for three of the past five years, and have earned more than $650 in a given year. If you contribute 25% yourself, you must contribute 25% of each eligible employee's salary. This rule is often overlooked, leading to IRS audits and collections.

The core appeal of a SEP IRA is its contribution flexibility. In a good year, you can contribute up to $66,000. In a bad year, you can contribute nothing. There are no minimum annual requirements and no late filing penalties. Restaurant owners are particularly benefited. Large contributions during peak season can offset slow-season losses.

The setup process is incredibly simple. Contact a brokerage firm like Schwab and fill out Form 5305-SEP online to get started. There's no annual testing or complex reporting required. You only need to submit Form 5498 at tax time. Investment options include a comprehensive portfolio of market ETFs, and annual fees are kept to a minimum of 0.10%.

However, compared to a solo 401k for small business owners, the SEP has significant shortcomings.

- No Roth option (all contributions are pre-tax).

- No loan feature.

- Contribution costs increase significantly with a large number of employees.

Applicable scenarios:

- Consulting firms with annual revenue fluctuating between $80,000 and $200,000.

- Hiring short-term contractors. Those with less than three years of service do not count as eligible employees.

- Business owners who dislike complex paperwork.

Click on the picture to create a website for your brand 👇

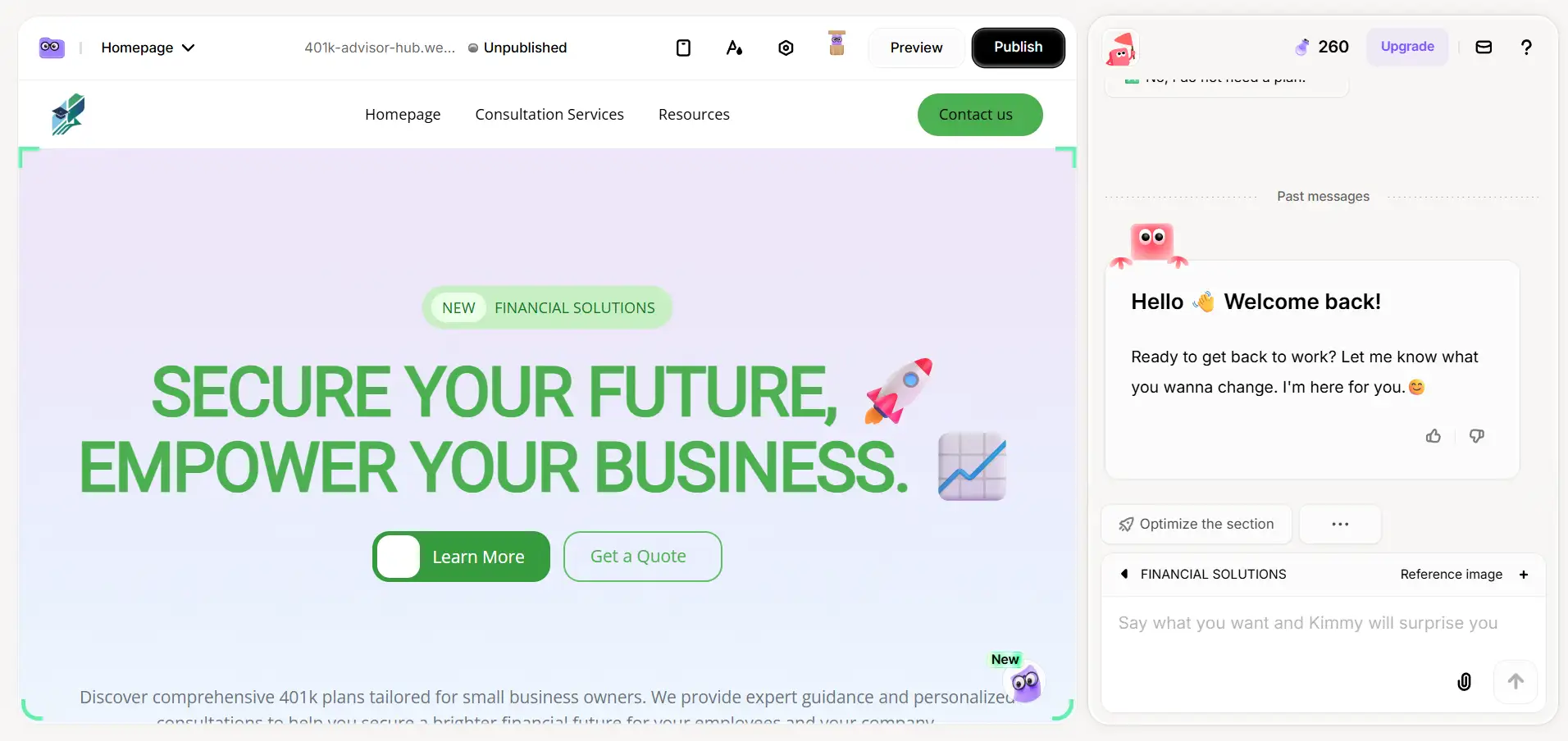

Build a Website with Wegic to Boost Your Business

After planning 401k for small business owners with employees, business owners often need to shift their energy to business growth. After all, a quality online presence can help you attract more customers and improve service promotion. For example, introduce your consulting business to potential clients. To simplify this process, Wegic is the best choice. Wegic is designed for busy bosses. It can help you create a professional website in just a few simple steps without any coding knowledge. What's more, it can boost your online business. This is especially useful for small business owners who have just set up a 401k account, as it makes your online presentation as efficient as your financial plan.

Wegic is your intelligent "growth partner". It can help you easily build websites and achieve results in growth.

Wegic is specially designed for small and micro business owners who pursue effective growth. It not only makes website building simple, but also directly empowers you with business. It is suitable for a variety of growth needs:

- Promote professional services

Through the conversation with AI on Wegic, a professional website is instantly generated to clearly show your service advantages. It allows potential customers to understand value at a glance and contact you with one click. This can effectively convert visitors into contracted customers.

- Online breakthrough of local business

Running cafes, studios, repair services, or small e-commerce? Tell AI about your needs, and Wegic helps you create eye-catching websites. They include product displays, menus/prices, event promotions, and online reservations orders. Through SEO, it can easily increase the local exposure of your store. This turns online visitors into offline passenger flow or online orders.

- Establish a passive customer acquisition system

What if you are a freelancer or craftsman? Wegic can generate websites that highlight your professional skills and case results. The site can become your 24-hour online sales representative. Potential customers can actively discover you when searching for services. For instance, 401k for small business owners.

- Shape brand trust and enhance value

No matter what industry you are in, Wegic can help you build a deeper image of customer trust and expertise. It helps you tell brand stories and share blogs. This not only improves conversion rate, but also supports higher customer unit prices and promotes customer loyalty.

- Focus on maximizing core business

More importantly, Wegic's AI-driven operations minimize website building costs and time. AI tools can free up valuable energy and budget for you. Then you can devote yourself to your core business. You can focus on optimizing your portfolio and serving existing customers. It's easy for you to open up new markets and improve products for more efficient and comprehensive development.

Step 1. Chat with AI

Tell AI about your business needs. For example, "Create a website to provide consultations in terms of 401k for small business owners". Wegic will automatically generate a personalized draft based on your description.

Step 2. Modify the website

If you don't like the design, you can adjust it and add content. For example, adding an introduction to your retirement plan service. The entire process is as intuitive as chatting, ensuring that the website perfectly matches your brand.

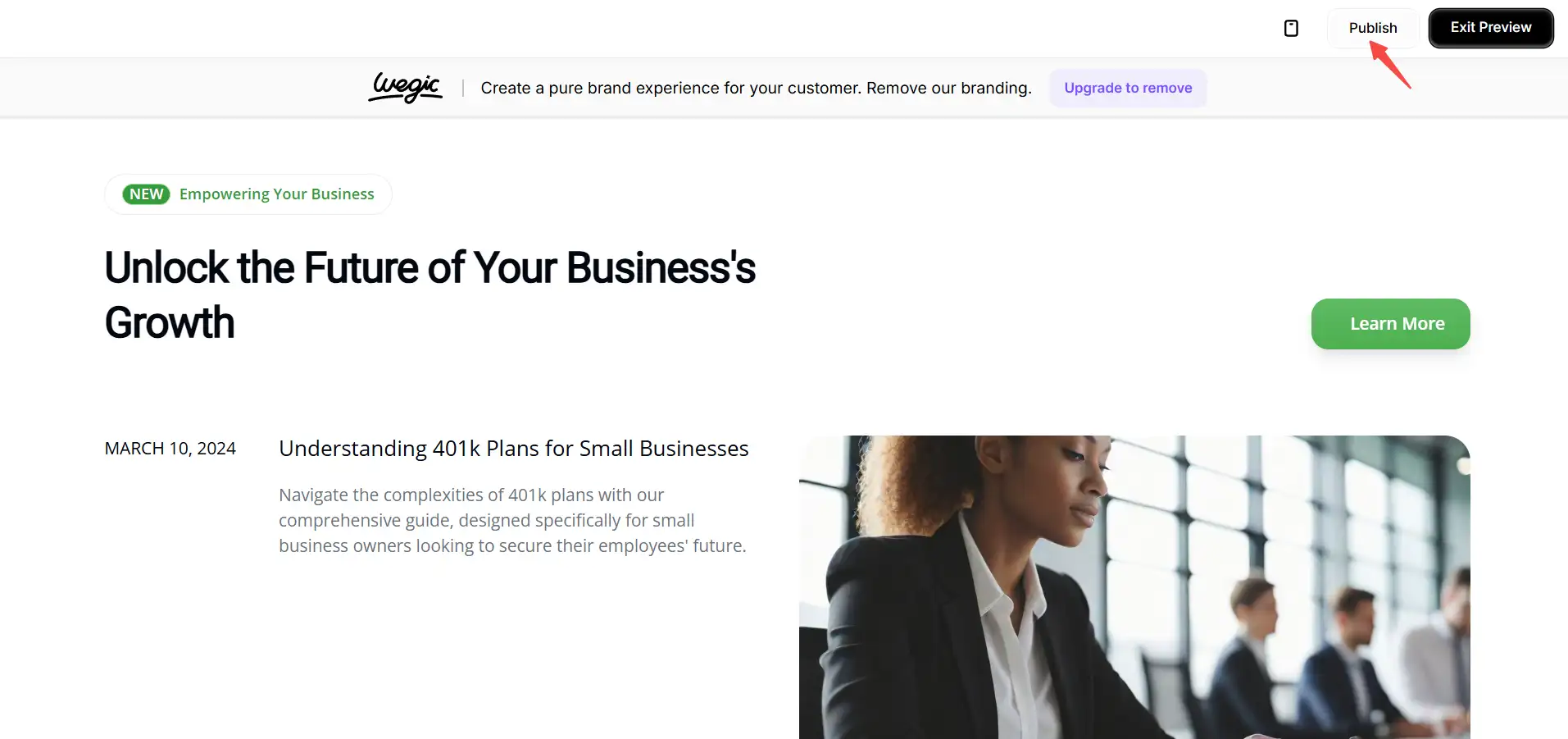

Step 3. Publish the website

Once you are satisfied, you can publish your website to the Internet with one click. The site will go online instantly. Your professional online portal takes effect immediately.

With Wegic, you can not only save time and cost, but also focus on your core businesses. For instance, optimizing strategies of the best 401k for small business owners or expanding your customer base. Whether you are creating a website or promoting your business, an AI-powered tool is key to improving visibility. Try Wegic now to build a strong foundation for your business!

Conclusion

Choosing the right retirement plan, like 401k for small business owners, is a major financial decision. Options like the Solo 401(k), SEP IRA, and SIMPLE IRA each have their advantages. A Solo 401(k) generally offers the highest savings potential for high-income self-employed individuals. A SEP IRA is known for its simplicity and flexibility. A SIMPLE IRA is a practical solution for small businesses with a small number of employees. A traditional 401(k) offers the most features for businesses with a team, including the potential benefits of a Roth 401(k) for small business owners. Carefully evaluate your business needs, income, and future goals. The 401k for small business owners or other retirement plans is the cornerstone of ensuring the financial security and comfortable retirement you deserve. Take control of your retirement future and start planning today. Try Wegic as a helper to promote your business online. Experience Wegic's AI website growth support immediately!

Written by

Kimmy

Published on

Sep 28, 2025

Share article

Read more

Our latest blog

Other

Feb 24, 2026

How Freelance Business Analysts Use Data Visualization Portfolios to Justify High Daily Rates

Other

Feb 24, 2026

How Independent Food Scientists Use Compliance Blogs to Attract Emerging Food Brands

Other

Feb 24, 2026

How Freelance Cloud Architects Use Service Packaging to Productize Complex Consulting

Webpages in a minute, powered by Wegic!

With Wegic, transform your needs into stunning, functional websites with advanced AI

Free trial with Wegic, build your site in a click!