Accesso

Construye Tu Sitio

What Small Business Owners Really Earn (With Real Examples)

Find out how many small business owners make and apply proven methods to boost your Small Business Owner Salary while building a Profitable Small Business.

Do you think all small business owners are earning a lot? The truth might surprise you. Are you still wondering "how much do small business owners make?" and whether the income from running a small business is really enough to make ends meet in a Profitable Small Business setup? Many imagine that "owning a business" means having an income far beyond reach — but in reality, small business owners' earnings vary widely. Some enjoy strong profits, while others struggle to stay afloat.

In this article, we'll cover:

- The real income range for small business owners today

- The key factors that determine how much a small business owner can actually earn

- An inside look — through three real-life examples (a café owner, an e-commerce seller, and a local service provider) — at how much of that revenue actually becomes take-home pay

Not only is it based on the latest authoritative data, but it also helps you understand in the most accessible way that"How much" isn't just about income data, it also depends on your industry, location, experience, profit structure, tax profile, and marketing prowess, especially if you're looking to leverage AI and smart platforms to increase your revenue in a targeted way.

How Much Do Small Business Owners Make

According to the latest statistics from the US Bureau of Labor Statistics (BLS), ZipRecruiter, and multiple industry survey agencies, the median Small Business Owner Salary is between $50,000 and $70,000, giving a clearer picture of "how much do small business owners make". This figure, however, is only a rough average — the actual numbers vary widely depending on the industry, the size of the business, and market conditions.

At the lower end of the scale — the bottom 25% of owners, the annual earnings can drop below $40,000. These businesses are often small in scale, operate on thin profit margins, and sometimes require owners to inject personal funds to keep the doors open. At the higher end — the top 25% — annual income can surpass $100,000, typically in higher-margin industries with stable customer bases and strong market positioning.

It's also critical to understand that "income" is not the same as "profit." Many first-time owners mistakenly equate total sales with income. Once fixed costs, variable expenses, taxes, and other obligations are subtracted, the actual take-home pay can be far lower. The reality is that impressive revenue on paper may translate into far more modest real earnings. To truly gauge how much a small business owner makes, you need to look beyond gross income and consider the business's profit structure and overall cash flow health.

| Metric | Typical Range | Data Notes |

| Annual Median Income | $50,000 – $70,000 | Actual figures vary widely depending on the type of industry and its market dynamics |

| 25th Percentile | $30,000 – $50,000 | Many independent owners operate on thin profit margins just to stay in business |

| 75th Percentile | $80,000 – $120,000+ | High-growth online and local service providers can reach or exceed this level |

| Core Factors Influencing Income | Industry, location, experience, profit margin, legal structure, marketing capabilities | A mix of controllable (skills, marketing) and uncontrollable (market conditions, location) factors |

Note: these data are classic references. Real income is affected by many factors. Let's break them down in detail.

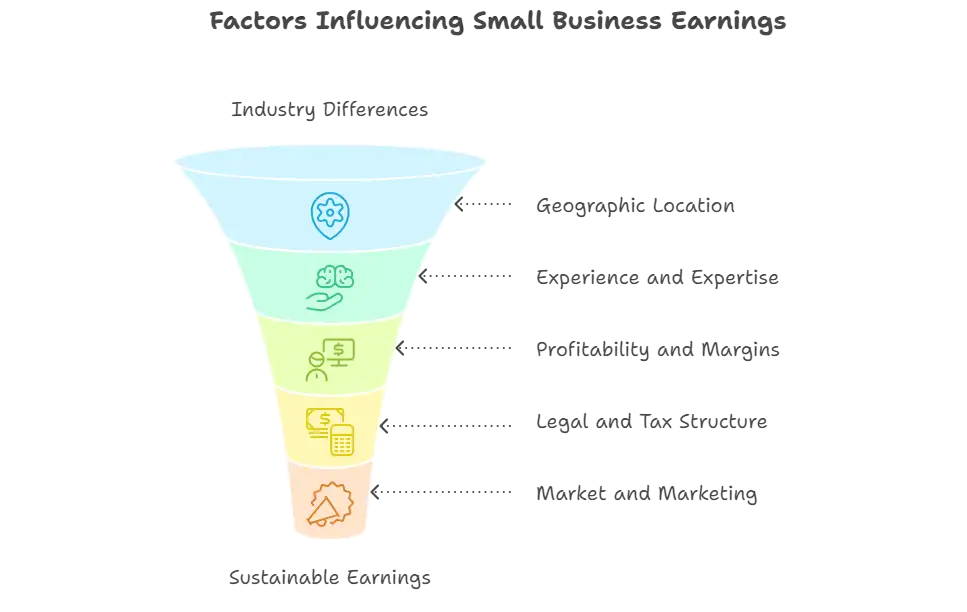

Six Key Factors Shaping Small Business Earnings

When exploring the question of "how much do small business owners make", it's important to understand that income, and a sustainable Small Business Owner Salary, is never just a single number. It's the outcome of multiple forces working together. Below are six core factors that explain why earnings can vary so dramatically.

1.Industry Differences

Your industry's profit model, market size, and gross margin directly influence potential earnings.

- High-margin industries, such as software, digital services, and creative consulting, have higher barriers to entry. Still, once a brand and customer base are established, profit margins often range from 20% to 50%.

- Low-margin industries, such as retail, food service, and logistics, may generate higher turnover, but hard costs, including rent and labor, compress margins, with net profits often under 10%.

- Business model impact: Subscription-based models can provide a steady, predictable revenue stream, while one-off transactions depend heavily on constant customer acquisition. Knowing your industry and model helps set realistic income ceilings and stability expectations.

2.Geographic Location

Where you operate matters. Local spending power, market competitiveness, and operating costs all shape your earnings.

- Spending power: Customers in large cities can pay more, but higher rent and labor costs can eat into profits.

- Competition density: Highly developed markets mean more competitors, demanding a stronger edge in branding, service quality, and marketing reach.

The same product might sell for nearly double in a prime urban location compared to a smaller market — but the higher price often comes with slimmer margins.

3.Experience and Expertise

Operational know-how, management skills, and the ability to integrate resources play a huge role in long-term profitability. Experienced owners tend to:

- Improve inventory turnover and cash flow efficiency

- Create standardized processes to minimize errors

- Adjust product lines and promotions strategically, raising prices or adding value-added services

Without this expertise, many entrepreneurs fall into the trap of being busy but barely profitable — assuming effort alone guarantees high earnings.

4.Profitability and Profit Margins

Revenue alone doesn't determine success — net margins and cost structure.

- High revenue + high costs: Quick turnover, little profit

- Moderate revenue + strong margins: More predictable take-home income

For example, $500,000 in revenue at a 20% margin yields $100,000 in profit, which outperforms $1 million in revenue with only $50,000 profit. Focus on net income, not just top-line sales.

5.Legal and Tax Structure

Your business entity directly affects how your income is taxed and how much you keep. In the U.S., small business owners often choose between:

- LLC / S-Corp allows you to optimize taxes through a balanced salary and dividend approach

- Sole proprietorship: Simple to set up, but higher personal income tax rates leave little room for optimization.

Structuring your pay, retaining earnings for reinvestment, or allocating for personal use are key strategies for maximizing take-home pay.

6.Market and Marketing Capability

Customer acquisition cost (CAC) and customer lifetime value (LTV) define your growth potential. Lowering CAC while boosting conversion rates is essential for raising income. Building brand content, encouraging repeat purchases, and increasing LTV are the foundations of sustained profitability. Leveraging digital marketing, social media, SEO, local search, and automated customer service can cut acquisition costs, improve customer satisfaction, and increase loyalty over time.

Real Cases: Three Small Business Owners from Different Fields

Case 1: Cambria "Cami" Wengert — From Nurse to Laundromat Entrepreneur

Background

Cambria (Cami) Wengert, once a nurse, decided during the pandemic to make a career change after experiencing burnout. She purchased a self-service laundromat for around $300,000, funding roughly two-thirds of the purchase by selling her home.

Operations

To boost performance, she expanded services to include wash, dry, pickup, and delivery, and installed vending machines offering laundry supplies to create new revenue streams. She also launched a TikTok account, @laundromatgirl, where she posted videos documenting the day-to-day operations of the laundromat and her personal transformation journey. These short videos quickly attracted a large audience, with views soaring into the millions, and she began sharing business tips with her growing follower base.

TikTok account, @laundromatgirlIncome Growth

Her annual earnings nearly tripled compared to her nursing salary. TikTok brand partnerships now add $3,000–$4,000 per month, while her online laundry business courses have generated as much as $26,000 in a single month, making her journey a true Profitable Small Business example.

Case 2: Bethany Holland — From NHS Nurse to Fashion Entrepreneur

Background

Former NHS nurse Bethany Holland always dreamed of starting her own business. Her journey began with a 50-pence second-hand scarf she redesigned and sold via social media. Her meticulous craftsmanship and eye for style drew a loyal following and consistent orders, evolving into the online handmade clothing brand Bethany Rae.

Bethany RaeOperations

As her community and customer base grew, she saved enough to open a physical boutique called Lavender Moon. What began as online creative resale developed into a hybrid business with both online and offline channels. According to media reports, her monthly turnover climbed from under £4,000 (about $5,000) to over £15,000 (about $19,000), with annual sales approaching £200,000 (about $250,000).

Income Structure

The combination of online and in-store sales tripled or even quadrupled her income, transforming her career path and providing a solid Small Business Owner Salary that even funded her dream wedding.

Case 3: Kọ Café Co-founders — Coffee Shop Meets Airbnb

Background

In Jersey City, New Jersey, the founders of Kọ Café initially rented their café space, but high rent and inconsistent revenue limited growth. They later decided to purchase the entire building for about $740,000, which included the café and two residential units upstairs.

Operations

They converted the upstairs units into Airbnb rentals, charging $140–$175 per night depending on the season, generating over $100,000 in annual rental income. This revenue covered nearly all of their $5,900 monthly mortgage payments, easing financial pressure. As property owners, they eliminated rent expenses and gained flexibility to adapt the space to their needs.

Kọ CaféRevenue Highlights

By combining commercial and residential use, the team secured two revenue streams: coffee shop profits and Airbnb rental income. This diversification stabilized cash flow, supported property value growth, and even drove cross-promotion, as Airbnb guests often visited the café during their stay.

Strategies to Boost Small Business Owners' Real Earnings

Once you understand the key factors that shape "how much do small business owners make," improving your actual take-home pay, and building a Profitable Small Business with a reliable Small Business Owner Salary becomes a matter of deliberate action. Below are five strategies, each explained in detail, to help small business owners drive growth from daily operations to strategic decision-making, ensuring a healthier and more sustainable income.

1.Optimize Your Cost Structure

Cost optimization isn't just about cutting expenses — it's about making every dollar work harder. Start by analyzing both fixed costs (rent, labor, insurance, equipment depreciation) and variable costs (materials, utilities, logistics, marketing) in detail. Look for opportunities to negotiate or switch suppliers, consolidate purchases, and reduce waste. Adjust business hours, streamline staffing, and compare the ROI of online vs. offline marketing to find the most cost-effective channels. Focus on high-margin products or services to lift overall profitability. Even a 1–2% improvement in profit margin can lead to substantial long-term gains. Through precise expense control and a focus on high-margin areas, you can maintain revenue while steadily growing net income.

2.Diversify Your Revenue Streams

Relying on a single source of income leaves you exposed to market volatility. Expand your offerings with membership programs, gift bundles, add-on services, custom options, and joint promotions. These not only enrich your product mix but also raise the average value per customer. A hair salon, for instance, could introduce subscription plans, family packages, or partnerships with beauty service providers, shifting from one-off sales to recurring revenue plus upsells. Partnering with complementary businesses — like cafés teaming up with bakeries or e-commerce stores working with logistics providers — can also unlock cross-promotion opportunities, broaden your reach, and create more stable growth.

3.Strengthen Customer Acquisition and Retention

Customers are the engine of revenue growth. To attract more of the right ones, enhance your online presence: improve your search rankings, use clear brand messaging and contact details, and showcase reviews or success stories to build trust. Boost visibility with email marketing, social media content, and online events. For retention, offer loyalty rewards, exclusive discounts, referral bonuses, birthday perks, and regular service packages. Each customer represents potential recurring revenue — improving both acquisition and retention lowers costs, stabilizes your income, and drives sustained growth over time.

4.Embrace Digital and Automated Operations

Leverage technology like a professional website, online payment systems, CRM tools, and inventory alerts to streamline operations, cut labor costs, and improve the customer experience. Automate repetitive tasks so you can focus on growth. Use AI chatbots to handle inquiries instantly, track visitor behavior, and analyze conversion paths to spot opportunities. For example, if data shows that cutting a low-performing ad boosts conversions by 15%, you can act immediately. Over time, standardized reports and accumulated insights help you make faster, smarter decisions on where to invest next. Digitalization not only saves time and resources but also improves decision-making and service quality — turning busyness into efficiency.

5.Plan Compensation and Taxes Strategically

Your business structure and tax strategy directly affect how much you take home. Choose the right payment structure for your entity type. For example, S-Corps allow you to combine a reasonable salary with dividends to reduce your tax burden, while LLCs and sole proprietorships require careful planning to avoid excessive tax liabilities. Maintain adequate cash reserves, reinvest strategically, and work with an accountant to create an annual tax plan that maximizes deductions and credits while staying compliant. The goal isn't just to "take more now," but to ensure you can take it steadily — building a flexible, resilient income structure for the long term.

Wegic – Your AI Assistant for Business

When it comes to boosting your income, digital and automation tools are often the smartest investments you can make. Wegic is an AI-driven website growth system designed to do exactly that. In just 60 seconds, it can launch a professional, fully customized website for your business — no coding required. From there, it handles automatic updates and ongoing maintenance, so you can save on labor costs and focus your energy where it matters most: running and growing your business.

Beyond website creation, Wegic offers built-in AI customer service and powerful data analytics, helping you attract more customers, understand your market, and continually refine your strategy. For small business owners aiming to increase revenue and expand their reach, Wegic acts as a full-time, always-on "online team" delivering value across every stage of growth:

- Launch Your Website in 60 Seconds

- Automatic Updates and Maintenance

- AI Customer Support

- Data Analytics and Actionable Insights

- Your Full-Time Online Operations Team

Click here to try Wegic

WegicConcluison

The income of small business owners, or"how much do small business owners make," is not fixed and unchanging, but is influenced by various factors such as industry, region, experience, profit margin, tax structure, and marketing capabilities that determine a sustainable Small Business Owner Salary.By streamlining costs, diversifying revenue streams, improving customer conversion rates, and embracing digital tools, you can significantly increase your take-home income.

If you're ready to make your business more efficient, smarter, and primed for growth, consider equipping it with an AI-powered growth support system. This will free up your time and energy to focus on what matters most — growing your core business — while the system handles the repetitive daily tasks. Try Wegic today and keep your business moving confidently forward in the era of digital transformation.

Escrito por

Kimmy

Publicado el

Oct 7, 2025

Compartir artículo

Leer más

Nuestro último blog

¡Páginas web en un minuto, impulsadas por Wegic!

Con Wegic, transforma tus necesidades en sitios web impresionantes y funcionales con AI avanzada

Prueba gratuita con Wegic, ¡construye tu sitio en un clic!